5 Best Free Online MACRS Depreciation Calculator Websites

Here is a list of best free online MACRS depreciation calculator websites. MACRS or Modified Accelerated Cost Recovery System depreciation is a method to calculate the depreciation of property for tax purposes. It allows businesses to recover the cost of their assets over a specific period through annual deductions. If also want to perform the MACRS depreciation calculations, then check out these online MACRS depreciation calculator websites.

These websites allow users to calculate the depreciation deduction for their assets based on the MACRS method. These calculators consider various parameters to perform MACRS depreciation calculations like asset’s cost, recovery period, depreciation method (General Depreciation System or the Alternative Depreciation System), etc. Some of these websites also explain the MACRS depreciation concept and provide step by step calculation process. Besides this, users also get the formula that these websites use to perform MACRS depreciation calculations. After performing the calculation, users get values like Depreciation Expense, Accumulated Depreciation, Ending Book Value, Yearly Basis Value, etc. To help new users, I have also included the necessary calculation steps in the description of each website.

These websites also offer additional online tools such as Average Calculator, Decimal Calculator, Discount Calculator, Displacement Calculator, etc. Go through the list to know more about these websites.

My Favorite Online MACRS Depreciation Calculator Website:

goodcalculators.com is my favorite website as it explains the MACRS depreciation concept and shows the steps to use this calculator. Plus, it also generates a graph highlighting the MACRS depreciation over a period of time.

You can also check out lists of best free Online Double Discount Calculator, Online MPC Calculator, and Online CBM Calculator websites.

Comparison Table:

| Features/Website Names | Shows calculation formula | Provides calculation steps | Shows MACRS Depreciation Graph |

|---|---|---|---|

| goodcalculators.com | ✓ | ✓ | ✓ |

| ecalculator.co | ✓ | ✓ | x |

| calculator-online.net | ✓ | ✓ | ✓ |

| allmath.com | x | x | x |

| nerdcounter.com | ✓ | ✓ | x |

goodcalculators.com

goodcalculators.com is a free online MACRS calculator website. Using this website, users can calculate the depreciation schedule of a property using the MACRS or Modified Accelerated Cost Recovery System. This calculator also calculates and shows the Depreciation Percentage Rate, Depreciation Expense for the year, Accumulated Depreciation, Book Value at the end of the year, and Depreciation method used in the calculation. Besides this, it also generates a Depreciation Over Time graph to visualize the depreciation value over a period of depreciation schedule.

To calculate all the MACRS values, it needs values of multiple parameters namely Basis, Business Usage, Recovery period, Depreciation Method, IRS Convention, and Date Placed in Service. Now, follow the below steps.

How to perform MACRS calculation online using goodcalculators.com:

- Visit this website using the given link.

- After that, manually enter all the required values such as basis, business usage, recovery period, etc.

- Next, click on the Calculate button to start the calculation process.

- Finally, view the calculated MACRS values.

Additional Features:

- This website also comes with additional online tools such as Car Depreciation Calculator, Annuity Depreciation Calculator, Percentage Depreciation Calculator, etc.

- It also offers a variety of online calculators covering topics like Mortgage, retirement, Salary & Income Tax, Loan, etc.

Final Thoughts:

It is a good online MACRS calculator website that can calculate all the essential MACRS depreciation parameters.

| Pros | Cons |

|---|---|

| Can calculate all essential MACRS parameters | |

| Offers steps to use the MACRS depreciation calculator |

ecalculator.co

ecalculator.co is another free online MACRS depreciation calculator website. Through this website, users can perform MACRS calculations to find out values like Depreciation Expense, Accumulated Depreciation, Ending Book Value, Yearly Basis Value, etc. This tool can also calculate the total depreciation percentage of a range of years.

This website also explains MACRS Depreciation and explains how the depreciation schedule work. It even shows the MACRS depreciation formula that it uses to perform the calculation. A sample MACRS depreciation table is also provided by it. Now, follow the below steps.

How to perform MACRS calculation online using ecalculator.co:

- Go to this website using the given link.

- After that, enter input values like Asset Name, Basis, Depreciation Method, Convention to use for the first year, etc.

- Next, click on the Calculate button to start the calculation process.

- In the end, view all the calculated values like depreciation expense, accumulated depreciation, ending book value, etc.

Additional Features:

- This website also offers a car depreciation calculator and a straight-line depreciation calculator.

Final Thoughts:

It is another good online MACRS depreciation calculator website that also shows the formula that it uses to perform the calculation.

| Pros | Cons |

|---|---|

| Shows MACRS depreciation calculation formula | |

| Provides a sample MACRS Depreciation Table |

calculator-online.net

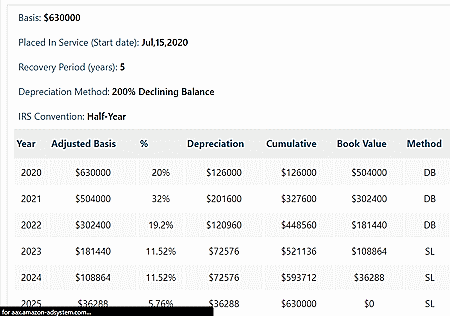

calculator-online.net is another free online MACRS depreciation calculator website. This website cannot only perform all the MACRS calculations but also explains MACRS calculations to users. It also shows the formula that it uses to perform the calculation. Plus, a Remaining Value vs Year graph highlighting the depreciation over a period of time is also generated by it. After performing the calculation, it shows calculated values like Adjusted Basis, Depreciation, Cumulative, Book Value, and Method used data. Now, follow the below steps.

How to perform MACRS depreciation calculation online using calculator-online.net:

- Visit this website and access the MACRS Depreciation Calculator.

- After that, enter all required input values such as Asses Cost, Property Used for business, Depreciation Method, Convention, etc,

- Next, click on the Calculate button to start the calculation process.

Additional Features:

- This website offers many additional calculators associated with fields like Maths, Finance, Chemistry, Statistics, etc.

Final Thoughts:

It is another good online MACRS depreciation calculator that also explains the calculation process and shows the calculation formulas.

| Pros | Cons |

|---|---|

| Shows MACRS depreciation calculation formula | |

| Also generates a graph |

allmath.com

allmath.com is another free online MACRS depreciation calculator website. This website offers multiple maths calculators including a MACRS depreciation calculator. This calculator uses Asset Name, Basis, Depreciation Method, Property Classification, Percentage property used for business, convention to use for the first year, etc. Besides this, it also lets users include Round and depreciation schedules in the calculation. Although, it doesn’t explain the calculation process nor it provides the MACRS calculation formula, unlike other similar calculators. Now, follow the below steps.

How to perform MACRS depreciation calculation online using allmath.com:

- Visit this website using the given link.

- After that, enter all required values like Asset name, Basis, property Classification, Month & Year placed in service, etc,

- Next, click on the Calculate button.

- Finally, view the calculated Depreciable Base, Depreciation % for, Depreciation expense for and other resultant values.

Additional Features:

- This website also offers additional online calculators such as Antenna Array, Arc Length, Average, Decimal, Discount, Displacement, etc.

Final Thoughts:

It is another good online MACRS depreciation calculator website that anyone can use without much hassle.

| Pros | Cons |

|---|---|

| Performs all essential MACRS calculations | Doesn’t explains MACRS depreciation nor provide the calculation formula |

nerdcounter.com

nerdcounter.com is the last free online MACRS depreciation calculator website. Using this website, users can quickly perform MACRS depreciation calculations involving parameters such as Basis, Recovery Period, Convention, Property used for business, Depreciation method, and Start Date values. After the calculation, it provides n years (recovery period) of depreciation schedule containing data like Adjusted basis, Depreciation, Cumulative Book Value, Method, etc.

This website also explains how MACRS depreciation calculation works. Besides this, it also offers multiple calculation examples along with the formula that it uses to perform the MACRS depreciation calculation. Now, follow the below steps.

How to perform MACRS depreciation calculation online using nerdcounter.com:

- Visit this website and open up the MACRS depreciation calculator.

- After that, enter all the required values in the available fields.

- Next, start the calculation by clicking on the Calculate button.

- Finally, view the depreciation schedule with all the necessary values in the Result section.

Additional Features:

- This website also comes with additional online calculators covering multiple financial, Mathematics, and Investing topics.

Final Thoughts:

It is another simple and effective online MACRS calculator website that also explains the calculation process.

| Pros | Cons |

|---|---|

| Explains the calculation process with examples | |

| Shows the MACRS calculation formula |

Frequently Asked Questions

The MACRS (Modified Accelerated Cost Recovery System) depreciation table provides the depreciation rates and recovery periods for various classes of assets under the General Depreciation System (GDS) and the Alternative Depreciation System (ADS). These tables are published by the IRS (Internal Revenue Service) and are used by businesses to calculate the depreciation expense for tax purposes.The MACRS (Modified Accelerated Cost Recovery System) depreciation table provides the depreciation rates and recovery periods for various classes of assets under the General Depreciation System (GDS) and the Alternative Depreciation System (ADS). These tables are published by the IRS (Internal Revenue Service) and are used by businesses to calculate the depreciation expense for tax purposes.

MACRS 5-year depreciation refers to the Modified Accelerated Cost Recovery System (MACRS) depreciation method applied to assets with a class life of 5 years for tax purposes in the United States. Under MACRS, assets are grouped into specific classes with predetermined recovery periods, and the 5-year property class is one of them. The MACRS 5-year depreciation is designed to allow businesses to recover the cost of qualifying assets over a five-year period through annual deductions. The depreciation rates for each year in the 5-year property class are as follows: Year 1: 20.00%, Year 2: 32.00%, Year 3: 19.20%, Year 4: 11.52%, Year 5: 11.52%.

MACRS 200% depreciation, also known as "double declining balance" or "200% declining balance," is a method of depreciation under the Modified Accelerated Cost Recovery System (MACRS) used for tax purposes in the United States. It is part of the General Depreciation System (GDS) and is specifically associated with certain property classes. The 200% depreciation refers to the depreciation rate used in this method, which is double the straight-line depreciation rate. Instead of depreciating the asset at a constant percentage each year, the double declining balance method accelerates the depreciation expense in the early years of the asset's life.

Naveen Kushwaha

Passionate about tech and science, always look for new tech solutions that can help me and others.

About Us

We are the team behind some of the most popular tech blogs, like: I LoveFree Software and Windows 8 Freeware.

More About UsArchives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014