35 Best Free Online Mortgage Overpayment Calculator Websites

Here is a list of the best free online mortgage overpayment calculator websites. A mortgage is a long-term loan that you have to pay over a certain period of time. You have to regularly pay recurring monthly repayments. Since it does charge a rate of interest so you also have to pay that interest on top of the principal amount. But if you have extra money at times, you can pay that towards your mortgage. This can help you save a decent amount of interest on your mortgage repayments.

There are two types of mortgage overpayment. The first one is to overpay your recurring mortgage repayments. For example, if your current recurring repayment is $1000, you can pay $1500. Along with recurring overpayment, you can also pay a lump sum amount. You have the choice to pay the recurring overpayment, a lump sum, or both. This reduces the remaining mortgage repayment period. However, it does not impact the remaining recurring repayment amount.

The second mortgage overpayment type is where you can pay the interest on the mortgage. This can also be a one-time payment, recurring payment, or both. Paying the interest reduces the recurring repayments amount while keeping the original mortgage term.

This post covers 35 free websites with mortgage overpayment calculators. It’s a combination of calculators for both mortgage overpayment types supporting multiple payment options. The overview table below briefs you on all these calculators. From there, you can jump to any calculator to read more and get the link to the Calculator itself.

My Favorite Online Mortgage Overpayment Calculator

I like NatWest.com’s mortgage overpayment calculator. This calculator works for repayment as well as for interest. It offers multiple payment options and generates a mortgage comparison table at the end. However, the selection of a calculator totally depends on the types of overpayment and what you want in the output. You can refer to the table and go through the post to find a calculator suitable for your specific needs.

You can also check out our other lists of the best free online Annuity Calculator websites, online Debt Ratio Calculator websites, and online Financial Leverage Ratio Calculator websites.

Overview Table

| Websites | Reccuring Overpayments | Lump Sum Payment | Both (Reccuring+Lump Sum) | Current vs Overpayment Mortgage Comparison |

|---|---|---|---|---|

| NatWest | Yes (R+I) | Yes (R+I) | Yes (R+I) | Chart |

| Halifax | Yes (R) | Yes (R) | Yes (R) | Chart & Table |

| TheMoneyCalculator | Yes (R) | Yes (I) | No | Chart, Table, Statement |

| BankofIreland | Yes (R) | Yes (R) | Yes (R) | No |

| Co-operativeBank | Yes (R) | No | No | No |

| MoneySuperMarket | Yes (R+I) | Yes (R+I) | Yes (R+I) | No |

| Santander | Yes | Yes | No | No |

| AIB.ie | Yes (R) | Yes (R) | Yes (R) | No |

| HSBC | Yes (R) | Yes (R) | No | No |

| Which.co.uk | Yes (R) | No | No | No |

| MoneyHub | Yes (R) | Yes (R) | Yes (R) | Chart & Table |

| GoodCalculators | Yes (R) | No | No | Chart & Table |

| AndrewsMortgageServices | Yes (R+I) | Yes (R+I) | Yes (R+I) | No |

| BBG.co.uk | Yes (R+I) | Yes (R+I) | Yes (R+I) | Chart |

| CandidMoney | Yes (R) | No | No | No |

| Charcol | Yes (R) | Yes (R) | Yes (R) | Table |

| Experian | Yes (R+I) | Yes (R+I) | Yes (R+I) | No |

| Money.co.uk | Yes (R) | Yes (R) | Yes (R) | No |

| MyMathTables | Yes (R) | No | No | Chart, Table, Statement |

| TheTimes.co.uk | Yes (R) | Yes (R) | No | No |

| BlueWingFinancials | Yes (R+I) | Yes (R+I) | Yes (R+I) | Chart |

| CCPC.ie | Yes (R) | Yes (R) | No | No |

| MortgageCalculator | Yes (R) | Yes (R) | Yes (R) | Table |

| Paulhoughton | Yes (R) | Yes (R) | Yes (R) | Chart & Table |

| LiquidExpatMortgages | Yes (R) | Yes (R) | Yes (R) | Chart & Table |

| Mortgagerates.info | Yes (R) | No | No | Payment Schedule |

| FamilyBuildingSociety | Yes (R+I) | Yes (R+I) | Yes (R+I) | No |

| EasyCalculation | Yes (R) | No | No | Payment Schedule |

| SainsburysBank | Yes (R) | Yes (R) | No | Chart & Table |

| MavenAdviser | Yes (R) | No | No | Table |

| HHMortgageConsultancy | Yes (R+I) | No | No | Chart & Table |

| NexMoney.co.uk | Yes (R) | No | No | No |

| Aussie.com.au | Yes (R) | No | No | No |

| StannardMcMahon | No | Yes (R) | No | Payment Schedule |

| NicolaAmidullaMortgages | Yes (R+I) | No | No | Chart & Table |

Note: In the above table, “R” is used for the Repayment mortgage type and “I” is used for the Interest mortgage type. The presence of R, I, or both alongside a payment option implies that the calculator works for those particular mortgage types with the mentioned payment method(s).

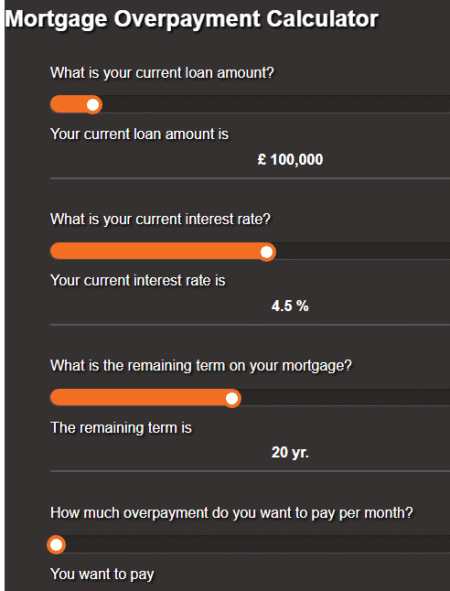

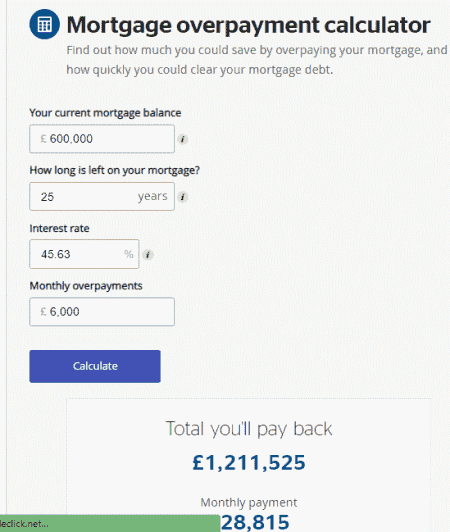

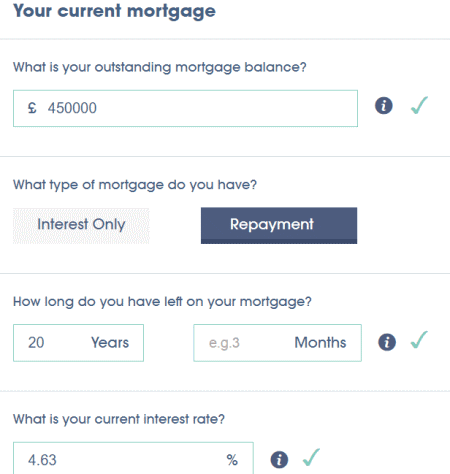

NatWest.com

Highlights:

- Overpayment Type: Recurring overpayments, lump sum, or both.

- Stats: New monthly repayment, potential mortgage reduction, and potential interest saving.

- Mortgage Comparison: Chart comparison of current mortgage and overpayment mortgage.

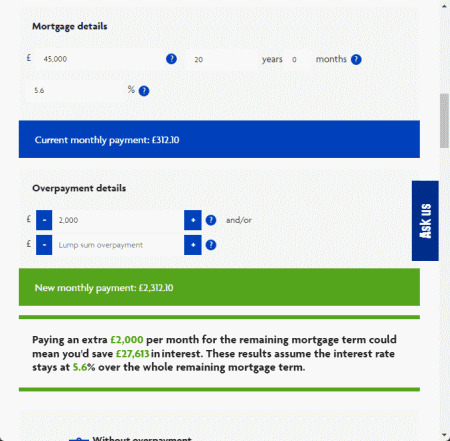

Halifax.co.uk

Highlights:

- Overpayment Type: Recurring overpayments and/or lump sum.

- Stats: New monthly repayment, potential mortgage reduction, and potential interest saving.

- Mortgage Comparison: Chart and Table comparison of remaining years of repayments.

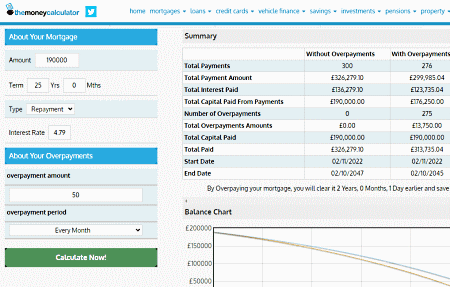

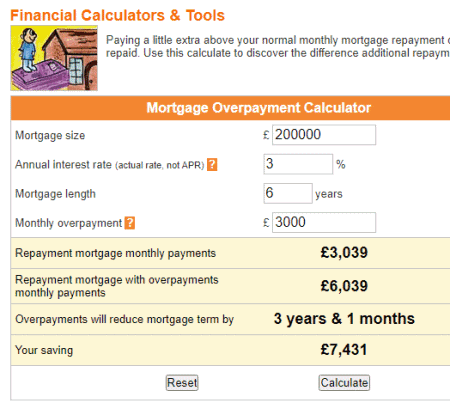

TheMoneyCalculator.com

TheMoneyCalculator.com is a free website with an online mortgage overpayment calculator. This is a simple calculator that you can use for recurring payments or interest only. After adding the mortgage details, you can select the type of payment you want to overpay towards the mortgage. Then you can add the payment you want to pay and select a period for recurring payment. This calculator offers over a dozen recurring time periods starting from one month to every 5 years. With that, you can go ahead with the calculations. The results give you a comparison table of mortgage without overpayment and mortgage with overpayment. It also plots a balance chart comparing the remaining mortgage time period.

Highlights:

- Overpayment Type: Recurring overpayments or interest only.

- Stats: New monthly repayment, potential mortgage reduction, and potential interest saving.

- Mortgage Comparison: Balance chart and Table comparison of remaining years of repayments.

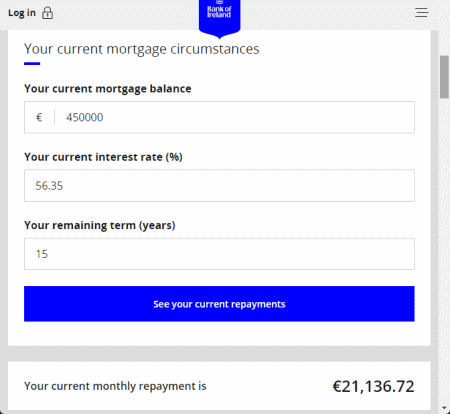

BankofIreland.com

BankofIreland.com also has a free online mortgage overpayment calculator. The website has a simple calculator where you can how quickly you can clear your mortgage by overpaying. This calculator has two overpayment options. You can enter either the increase to your monthly repayment, a lump sum payment amount, or both to calculate your savings. With that, it tells you the interest savings and mortgage term reduction.

Highlights:

- Overpayment Type: Recurring overpayments and/or lump sum.

- Stats: Potential interest savings, and potential mortgage term reduction.

- Mortgage Comparison: No comparison.

Co-operativeBank.co.uk

Co-operativeBank.co.uk website can help you calculate mortgage overpayment calculation. It offers a simple mortgage overpayment calculator for that. The calculator tells you how much interest you would save and reduce your mortgage time period by paying extra on top of your monthly payment. To do that, you have to add your mortgage details along with the additional monthly overpayment amount. With that, it gives you interest savings and term reduction. That’s all you get here, it does not give any sort of comparison of mortgage or any other analysis.

Highlights:

- Overpayment Type: Recurring monthly overpayments.

- Stats: Potential interest savings, and potential mortgage term reduction.

- Mortgage Comparison: No comparison.

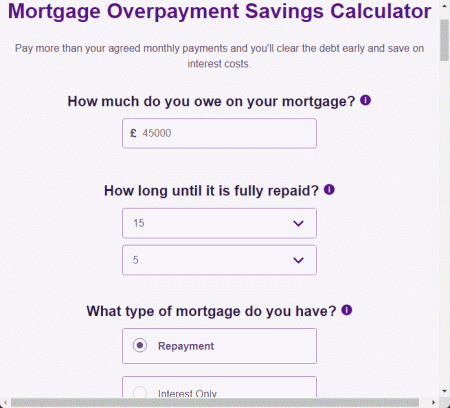

MoneySuperMarket.com

MoneySuperMarket.com offers a free online mortgage overpayment calculator. This calculator works for two types of mortgage; “Repayment” and “Interest”. In either case, you can a recurring payment, a one-time payment, or both. Going with the “Repayment” would reduce your mortgage period. Whereas, going with the “Interest” would not impact the mortgage period but decrease the repayment amount and thus the recurring repayments. In the end, the calculator gives you respective results based on the mortgage type you select at the beginning.

Highlights:

- Overpayment Type: Recurring overpayments, Lump sum, or both (for repayment or interest).

- Stats: Potential interest savings and potential mortgage term reduction or mortgage amount reduction.

- Mortgage Comparison: No comparison.

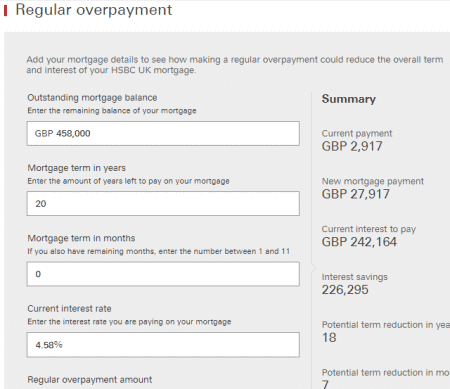

Santander.co.uk

Santander.co.uk is another free website with an online mortgage overpayment calculator. You can use this calculator to calculate mortgage interest savings and mortgage reduction when you overpay. It supports two types of overpayments; recurring overpayment and single overpayment. The recurring overpayment has to match your monthly mortgage repayment and you can select for how long you would overpay the additional amount. With that, the calculator shows you the new monthly repayment amount along with potential interest savings and mortgage time reduction.

Highlights:

- Overpayment Type: Recurring overpayments or a lump sum overpayment.

- Stats: New monthly repayment, potential mortgage reduction, and potential interest saving.

- Mortgage Comparison: No comparison.

AIB.ie

AIB.ie has a free online mortgage overpayment calculator. This calculator is useful when you want to pay more than your normal repayments off your mortgage with an extra monthly payment or a lump sum payment, or both. You can simply add your mortgage details into the calculator and then enter the overpayment amount along with the optional lump sum payment. With that, the calculator shows you the total amount of interest you could save, revised repayment term, term reduction, new monthly repayment, and revised mortgage balance.

Highlights:

- Overpayment Type: Recurring overpayments and/or lump sum.

- Stats: New monthly repayment, potential mortgage reduction, and potential interest saving.

- Mortgage Comparison: No comparison.

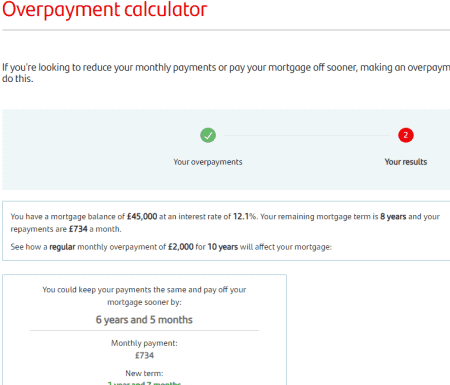

HSBC.co.uk

HSBC.co.uk website offers a free online mortgage overpayment calculator. With this calculator, you can calculate mortgage overpayment for a recurring payment or lump sum payment. The website offers two separate calculators for the above-mentioned types of repayment. You can use a calculator as per your plan of overpayment. Each calculator gives you interest savings and mortgage term reduction.

Highlights:

- Overpayment Type: Recurring overpayments or lump sum.

- Stats: New monthly repayment, potential mortgage reduction, and potential interest saving.

- Mortgage Comparison: No comparison.

Which.co.uk

Which.co.uk is another website to calculate mortgage overpayment online. The website offers a calculator where you can find the impact of overpaying monthly towards your mortgage. You can type the amount you want to overpay along with your mortgage details. The results give you the new monthly repayment (repayment+overpayment, new mortgage term after reduction, and the amount of interest you could save.

Highlights:

- Overpayment Type: Recurring overpayments.

- Stats: New monthly repayment, potential mortgage reduction, and potential interest saving.

- Mortgage Comparison: No comparison.

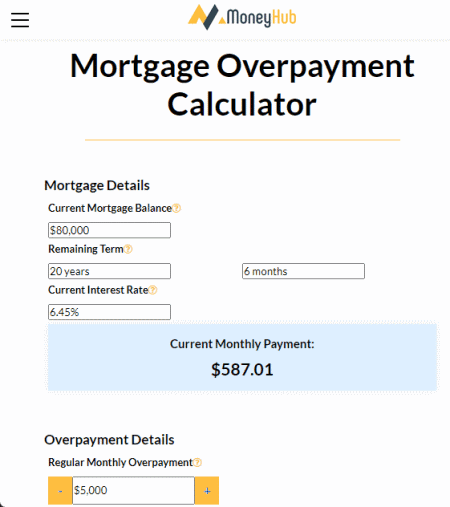

MoneyHub.co.nz

MoneyHub.co.nz has a free online mortgage overpayment calculator. This calculator can help you determine your mortgage with a regular monthly overpayment and/or with a lump sum overpayment. You can pick either or both overpayment options and add your financial data to the calculator. With that, the calculator gives you the new monthly payment along with the amount of interest you can save. It also makes a yearly comparison table of current and new mortgages and plots a chart from the same.

Highlights:

- Overpayment Type: Recurring overpayments and/or lump sum.

- Stats: New monthly repayment, potential mortgage reduction, and potential interest saving.

- Mortgage Comparison: Chart and Table comparison of remaining years of repayments.

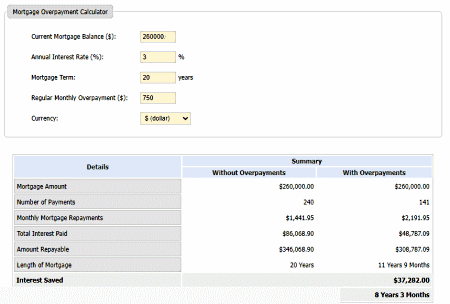

GoodCalculators.com

GoodCalculators.com also has a free online mortgage overpayment calculator. This calculator works for regular monthly overpayments. Along with the mortgage details, you can set the amount that you want to overpay monthly. Then the calculator gives you a summary where it shows the new monthly repayment amount, number of payments, interest, payable amount, length of the mortgage, and interest savings. It shows these data points for current and new mortgages. Along with that, it also shows the balance schedule of both mortgages and plots a chart comparing the mortgage terms.

Highlights:

- Overpayment Type: Recurring monthly overpayments.

- Stats: New monthly repayment, potential mortgage reduction, and potential interest savings.

- Mortgage Comparison: Chart and Table comparison of remaining years of repayments.

AndrewsMortgageServices.co.uk

AndrewsMortgageServices.co.uk offers a free online mortgage overpayment calculator. You can use this calculator for mortgage repayment or interest. You can pick the type of mortgage overpayment you want to do. In both cases, you can pay a monthly overpayment, a lump sum, or both. Simply add the payments to the calculator as per your situation. When you do that, the calculator gives you the new mortgage term and amount of interest that you can save by overpaying. In the case of interest payment, it gives your new mortgage balance and interest savings.

Highlights:

- Overpayment Type: Recurring overpayments, Lump sum, or both (for repayment or interest).

- Stats: Potential interest savings and potential mortgage term reduction or mortgage amount reduction.

- Mortgage Comparison: No comparison.

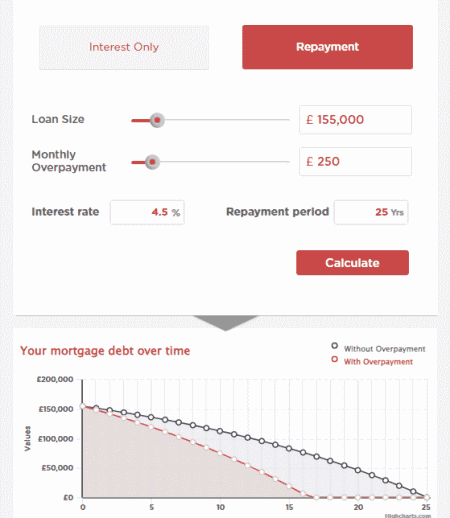

BBG.co.uk

BBG.co.uk has a free online mortgage overpayment calculator. This calculator can help you calculate mortgage term reduction for repayment and mortgage amount reduction for interest overpayment. You can start by selecting the type of mortgage i.e., Repayment or Interest. Then you can add the mortgage details. You can go with a monthly repayment, a lump sum, or both. In the case of Repayment, the calculator tells you the interest saving and new mortgage term with overpayment. And for the Interest mortgage, it shows the interest savings and mortgage balance with overpayment.

Highlights:

- Overpayment Type: Recurring overpayments, Lump sum, or both (for repayment or interest).

- Stats: Potential interest savings and potential mortgage term reduction (for repayments) or mortgage amount reduction (for interest payments).

- Mortgage Comparison: Chart comparison of remaining years of repayments.

CandidMoney.com

CandidMoney.com is a free website with an online mortgage overpayment calculator. This calculator can calculate the mortgage repayment for the recurring overpayment. You can define the amount of money that you want to pay over your current monthly repayment. With that, this calculator gives you the new monthly repayment along with the reduction in mortgage term and interest savings.

Highlights:

- Overpayment Type: Recurring monthly overpayments.

- Stats: New monthly repayment, Potential interest savings, and potential mortgage term reduction.

- Mortgage Comparison: No comparison.

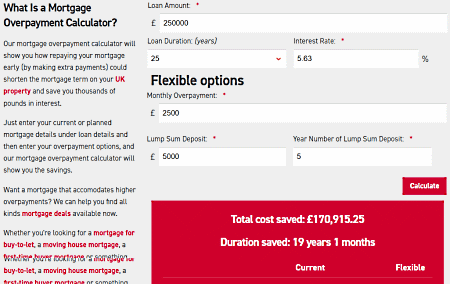

Charcol.co.uk

Charcol.co.uk offers another simple online mortgage overpayment calculator. This calculator calculates the new mortgage amount and mortgage terms for recurring overpayments. You can simply add your current mortgage loan amount, duration, and interest rate. Then you can add your monthly overpayment along with an optional lump sum. You can also set in which year you want to pay the lump sum. This gets you a side-by-side comparison of the current mortgage loan and the same with overpayment.

Highlights:

- Overpayment Type: Recurring overpayments and/or lump sum.

- Stats: Monthly repayment, total cost, and loan duration.

- Mortgage Comparison: Side-by-side comparison.

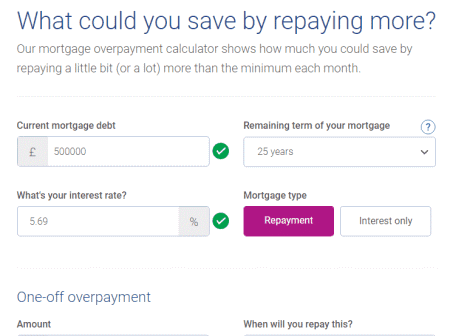

Experian.co.uk

Experian.co.uk also has a free online mortgage overpayment calculator. This calculator shows how much you could save by repaying more than the minimum each month. It works for the Repayment and Interest mortgage types. You can select the type of mortgage as per your calculation and then add the mortgage loan details. Then as per the mortgage type selection, you can go with a one-time payment, recurring payment, or both. For the one-time payment, you can set the date of the payment. Similarly, for recurring payments, you can set the frequency. This way, you can calculate the interest savings and mortgage term reduction or mortgage balance reduction using this calculator.

Highlights:

- Overpayment Type: Recurring overpayments, Lump sum, or both (for repayment or interest).

- Stats: Potential interest savings and potential mortgage term reduction (for repayment) or mortgage amount reduction (for interest).

- Mortgage Comparison: No comparison.

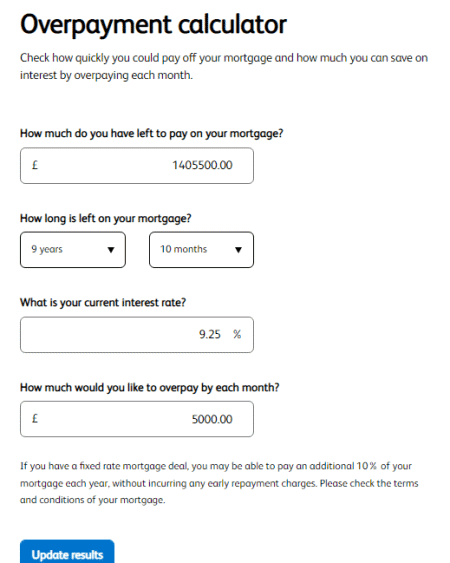

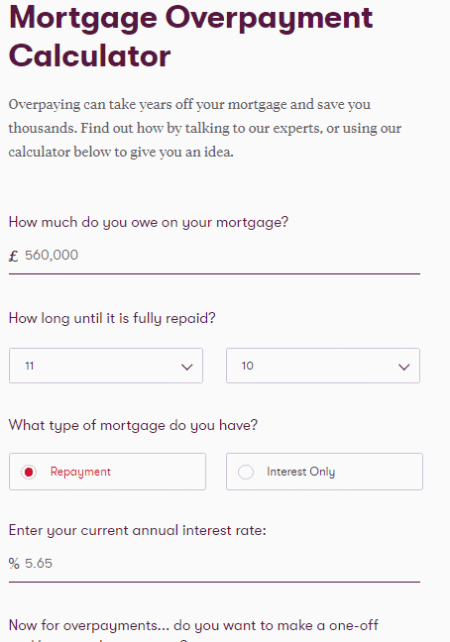

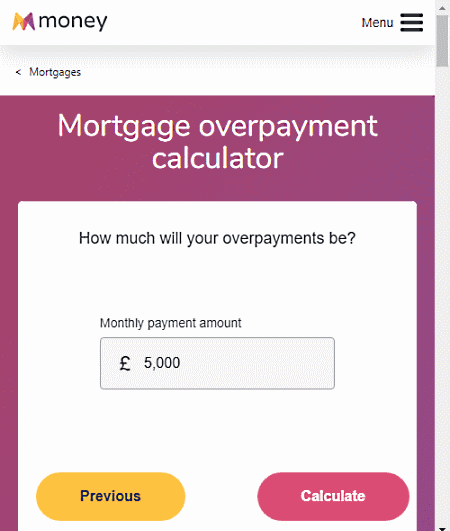

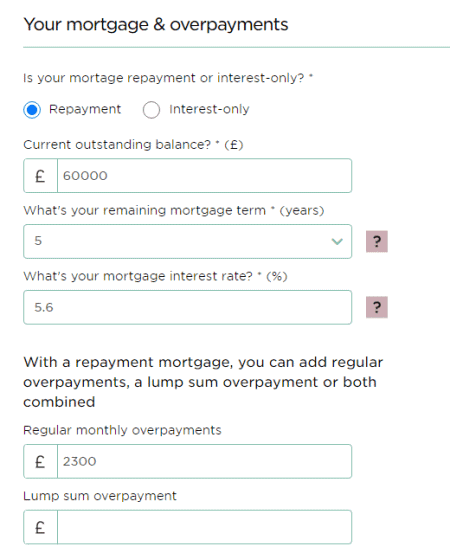

Money.co.uk

Money.co.uk offers a free online mortgage overpayment calculator. This calculator has a step-by-step process for calculation. It works for the Repayment mortgage type. You can add your mortgage details and then pick whether you want to go with monthly repayment, one-time payment, or both. Then you can add the overpayment as per the selection and calculate the new mortgage balance and term with overpayment.

Highlights:

- Overpayment Type: Recurring overpayments and/or lump sum.

- Stats: New monthly repayment, potential mortgage reduction, and potential interest saving.

- Mortgage Comparison: No comparison.

MyMathTables.com

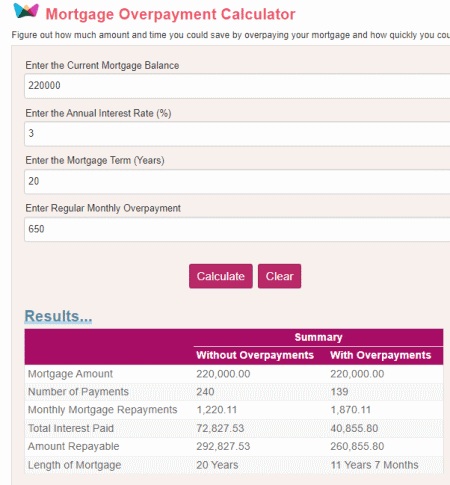

MyMathTables.com is a free website with a wide collection of online calculators. It also offers an online mortgage overpayment calculator. You can use this calculator to determine new mortgage information for regular monthly overpayments. All you have to add your current mortgage balance, time period, interest rate, and the monthly overpayment you want to pay. With that, it generates a table where it compares the current mortgage with the new mortgage covering the number of payments, monthly payment amount, interest paid, amount repayable, and mortgage length. It also generates a Balance Schedule comparing yearly mortgages with and without overpayments.

Highlights:

- Overpayment Type: Recurring overpayments.

- Stats: New monthly repayment, potential mortgage reduction, and potential interest saving.

- Mortgage Comparison: Current and New mortgage summary and Balance Schedule.

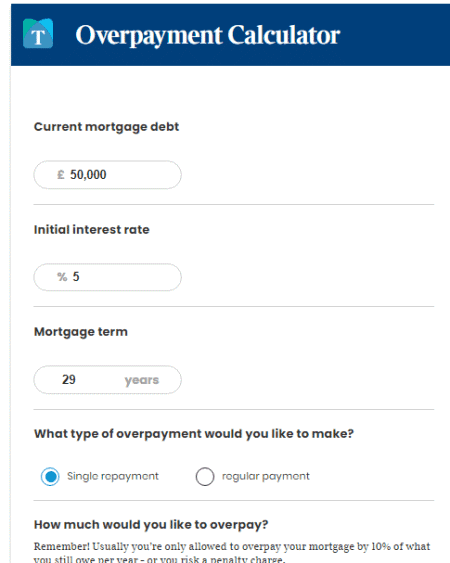

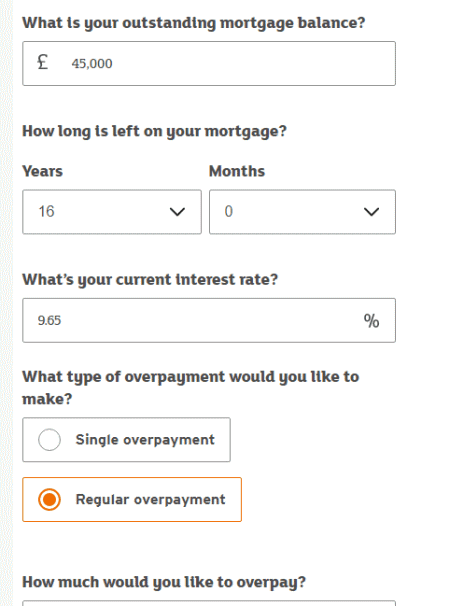

TheTimes.co.uk

TheTimes.co.uk offers another free online mortgage overpayment calculator. This calculator works with a repayment-type mortgage. You can add your current mortgage balance to the calculator along with the interest rate and mortgage term. Then you can select between single overpayment or regular overpayment. In the case of regular overpayment, you can set for how long you would make the overpayment. With all that input, the calculator gets you the monthly mortgage payment, potential interest savings, and reduced mortgage term.

Highlights:

- Overpayment Type: Single Payment or Recurring overpayments.

- Stats: New monthly repayment, potential mortgage reduction, and potential interest saving.

- Mortgage Comparison: No comparison.

BlueWingFinancials.co.uk

BlueWingFinancials.co.uk is another free website with a mortgage overpayment calculator. This calculator works with both types of mortgages; Repayment and Interest. You have to start by adding your mortgage information. After that, you can simply add an overpayment of your choice. You can make it a repayment or an interest. In both cases, you can go with recurring payment, lump sum, or both. Similarly, you can add multiple repayments if you want. In the output, it gives you information on the mortgage with overpayment. It also plots an interactive chart comparing both mortgages. You can hover over the chart to get the information for any given year.

Highlights:

- Overpayment Type: Recurring overpayments, Lump sum, or both (for repayment or interest).

- Stats: Potential interest savings and potential mortgage term reduction (for repayments) or mortgage amount reduction (for interest payments).

- Mortgage Comparison: Chart comparison of remaining years of repayments.

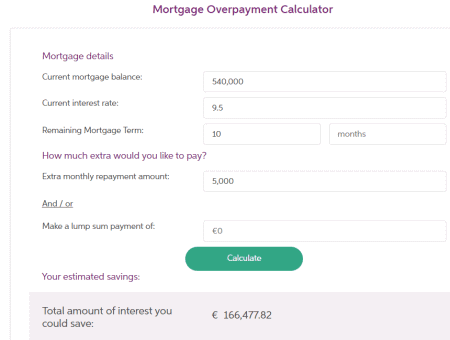

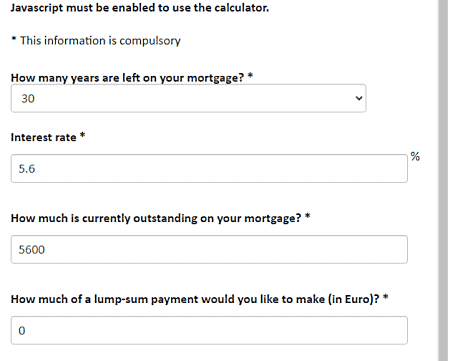

CCPC.ie

CCPC.ie is another free website with a mortgage overpayment calculator. With the help of this calculator, you can determine the impact of mortgage overpayment for a one-time payment or a recurring monthly overpayment. All you have to do is enter your mortgage details into the calculator along with the overpayment type of choice. With that, the calculator shows you the impact of the overpayment on the mortgage covering the new mortgage period and interest savings.

Highlights:

- Overpayment Type: Recurring overpayments or lump sum.

- Stats: New monthly repayment, potential mortgage reduction, and potential interest saving.

- Mortgage Comparison: No comparison.

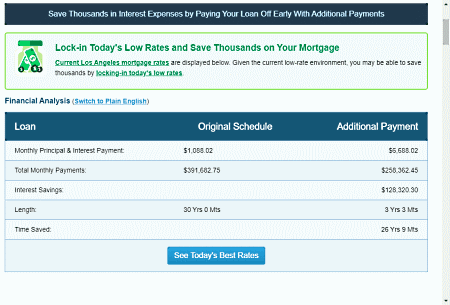

MortgageCalculator.org

MortgageCalculator.org offers a free online mortgage overpayment calculator. This calculator works for the repayment mortgage type. You can add your mortgage details and then pick whether you want to go with monthly repayment, one-time payment, or both. Along with your mortgage information, you can add the overpayment of choice and go ahead with the calculation. The result compares the mortgage with and without overpayment. It shows you the interest you could save along with a potential reduction in the mortgage term.

Highlights:

- Overpayment Type: Recurring overpayments and/or lump sum.

- Stats: New monthly repayment, potential mortgage reduction, and potential interest saving.

- Mortgage Comparison: Side-by-side comparison.

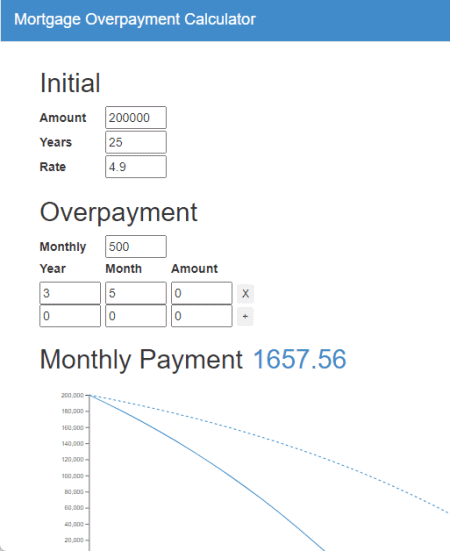

Paulhoughton.Github.io

Paulhoughton.Github.io is a free online mortgage overpayment calculator. This is a simple calculator that you can use for recurring overpayments as well as a lump sum. It lets you include multiple lump sum amounts at specific years and months. With that, it shows you the new monthly repayment of the mortgage. It generates a table where it shows the yearly interest, overpayment, and balance of the mortgage. It also plots a chart comparing the new mortgage term with the old one.

Highlights:

- Overpayment Type: Recurring overpayments and/or lump sum payments.

- Stats: New monthly repayment.

- Mortgage Comparison: Chart and Table of remaining years of repayments.

LiquidExpatMortgages.com

LiquidExpatMortgages.com is another free website where you can calculate mortgage overpayment online. It works for repayment types of mortgages means it shows by how much margin you can reduce your mortgage term by paying extra. It supports both types of payments; monthly overpayment and lump sum. The lump sum payment is optional. You can use either one or both as per your situation. With that, the calculator gives you current and new mortgage payment comparisons using a yearly table and a chart.

Highlights:

- Overpayment Type: Recurring overpayments and/or lump sum.

- Stats: New monthly repayment, potential mortgage reduction, and potential interest saving.

- Mortgage Comparison: Chart and Table comparison of remaining years of repayments.

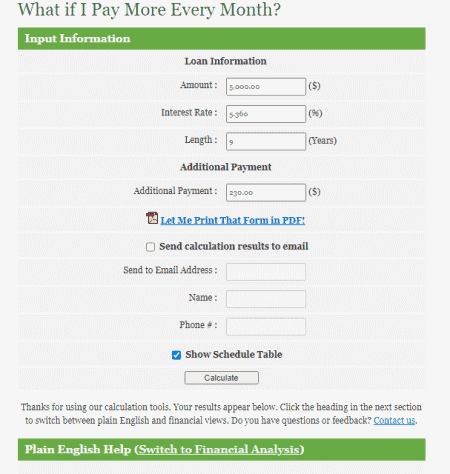

Mortgagerates.info

Mortgagerates.info offers another free online mortgage overpayment calculator. This calculator has a simple interface where you have to add your mortgage details. Along with that, you get a section to add the additional payment. This is for the additional amount you want to pay over your current monthly repayment. With those inputs, it gives you the new monthly payment along with interest savings, and the new mortgage time period. This calculator also generates a payment schedule where it gives you a payment summary of every month of the remaining mortgage term. One additional feature of this calculator is that you can send the results of the calculation via email.

Highlights:

- Overpayment Type: Recurring overpayments.

- Stats: New monthly repayment, potential mortgage reduction, and potential interest saving.

- Mortgage Comparison: Monthly payment schedule table.

FamilyBuildingSociety.co.uk

FamilyBuildingSociety.co.uk is another website that you can use to calculate mortgage overpayment online. This calculator works for payment mortgage type as well as interest mortgage type. You can pick the type of mortgage and add your mortgage information. Coming to the overpayment, it supports both, recurring monthly overpayment and lump sum. You can go with the additional amount you would pay over your current repayment along with an optional lump sum payment. With those inputs, the calculator gives you the new mortgage term and amount of interest that you can save by overpaying. In the case of interest payment, it gives your new mortgage balance and interest savings.

Highlights:

- Overpayment Type: Recurring overpayments, Lump sum, or both (for repayment or interest).

- Stats: Potential interest savings and potential mortgage term reduction (for repayment) or mortgage amount reduction (for interest).

- Mortgage Comparison: No comparison.

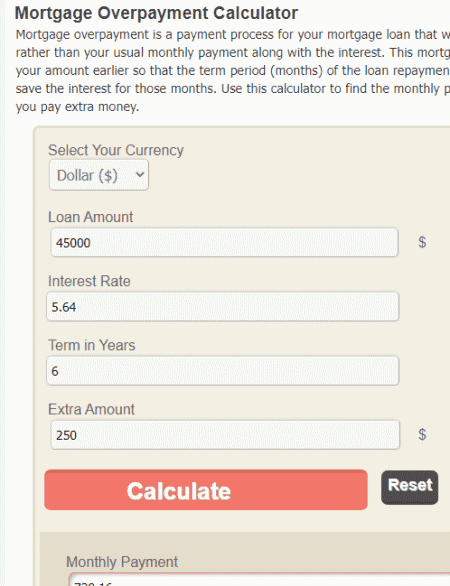

EasyCalculation.com

EasyCalculation.com is a website that offers a wide collection of online calculators. Under its collection of financial calculators, you can find a mortgage overpayment calculator. This calculator has a simple interface and works for repayment mortgage types. Along with the mortgage information, you can add the additional amount you want to pay over your current monthly repayment. With those inputs, it gives you the new monthly payment overall and paid interest with and without overpayments. Below that, it generates a table of a payment summary of every month of the remaining mortgage period.

Highlights:

- Overpayment Type: Additional monthly overpayment.

- Stats: New monthly repayment, overall interest, and interest paid.

- Mortgage Comparison: Monthly payment schedule table.

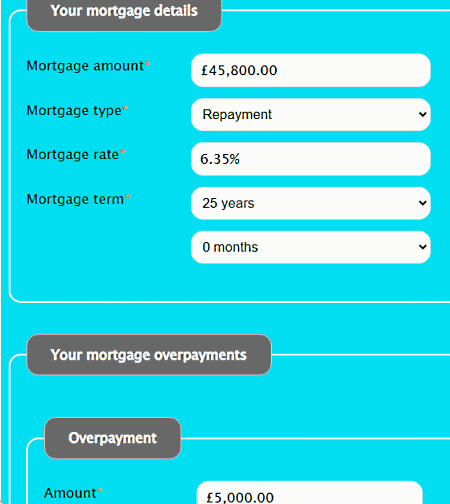

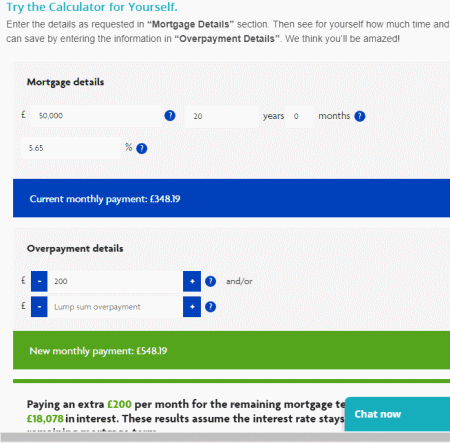

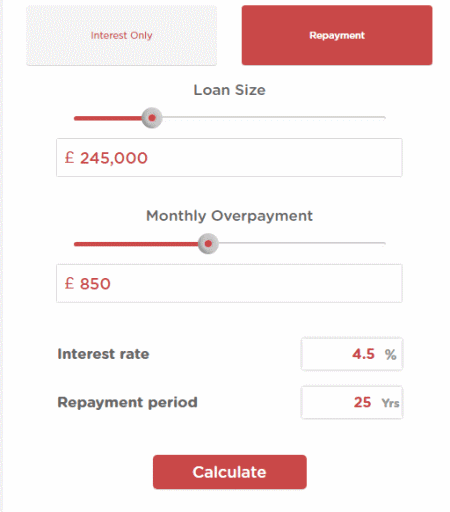

SainsburysBank.co.uk

SainsburysBank.co.uk offers a free online mortgage overpayment calculator. This calculator works for repayment mortgage types. It has two overpayment options; recurring and one-time payment. You can go with either of those options for the calculation. The results of the calculation give you the new monthly payment amount, interesting savings, and reduced mortgage terms. It also plots a chart comparing mortgages with and without overpayments. Below that chart, you get a table showing the comparison of the mortgage repayment summary for the remaining years.

Highlights:

- Overpayment Type: Recurring monthly overpayments.

- Stats: New monthly repayment, potential mortgage reduction, and potential interest savings.

- Mortgage Comparison: Chart and Table comparison of remaining years of repayments.

MavenAdviser.com

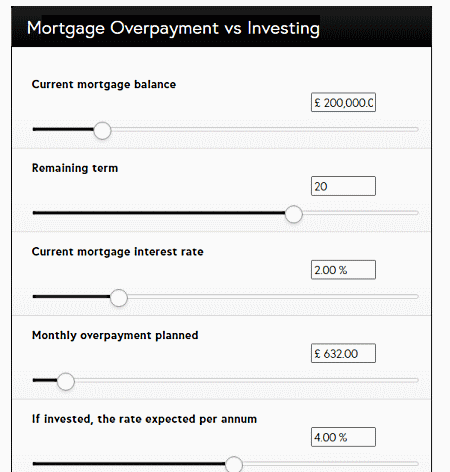

MavenAdviser.com is a slightly unique mortgage overpayment calculator. This calculator works like any other calculator on this list. It is for repayment mortgage type and supports monthly overpayment only. The unique aspect is that it can compare the outcome if you invest the overpayment amount instead of paying it towards the mortgage. So you can pick the inverstment interest while adding all the information. It shows all the mortgage information covering new monthly payments, interest savings, and mortgage term reduction. In fact, it also compares mortgages with and without overpayment over years. But in the end, it gives you the interest savings you get with the overpayment and the return you get if you go with the investment instead.

Highlights:

- Overpayment Type: Additional monthly overpayment.

- Stats: New monthly repayment, interest savings, and mortgage term reduction.

- Mortgage Comparison: A table of comparison of mortgages with and without overpayment.

- Additional Feature: Compares overpayment savings and investment returns on the same amount over time.

HHMortgageConsultancy.co.uk

HHMortgageConsultancy.co.uk is another free online mortgage overpayment calculator. You can use this calculator for repayment mortgages as well as interest mortgages. If you want to reduce the term of your mortgage by overpaying then you can go with the repayment mortgage option. And if you want to decrease the monthly payment then you can go with the interest mortgage option. In either case, you can add the additional amount you want to pay per month over the current monthly repayment. There is no option for a one-time lump sum payment here. This calculator shows you the potential interest saving and term reduction for repayment. It also generates a chart and table comparing the mortgages with and without overpayment. Whereas in the case of interest, it gives you the reduced mortgage balance along with a comparison chart and a comparison table.

Highlights:

- Overpayment Type: Recurring monthly overpayments (for repayment or interest).

- Stats: New monthly repayment, potential interest saving, potential mortgage reduction (for repayment), and potential repayment decrease (for interest).

- Mortgage Comparison: Chart and Table comparison of remaining years of repayments.

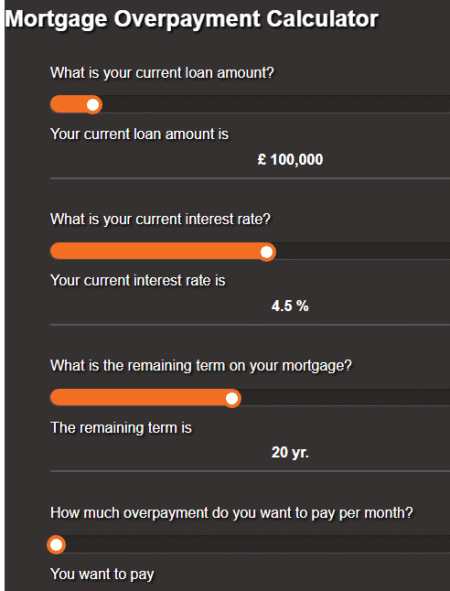

NexMoney.co.uk

NexMoney.co.uk is another website with a free mortgage overpayment calculator. It has a simple calculator where you can add the values directly or use the sliders to do the same. The calculator tells you how much interest you would save and reduce your mortgage time period by paying extra on top of your monthly payment. To do that, you have to add your mortgage details along with the additional monthly overpayment amount. The output gives you interest savings and term reduction.

Highlights:

- Overpayment Type: Recurring monthly overpayments.

- Stats: Potential interest savings, and potential mortgage term reduction.

- Mortgage Comparison: No comparison.

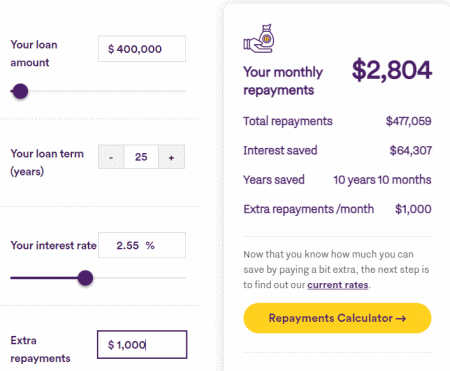

Aussie.com.au

Aussie.com.au also offers a free website with an online mortgage overpayment calculator. This calculator can calculate the mortgage repayment for the recurring overpayment. You get the option to choose how frequently you want to make the overpayment. You can with monthly, fortnightly, or weekly. And if you want to make an overpayment for a specific interval of years and not all the way, you get an option to set the number of years for that. With all that, this calculator gives you the new monthly repayment along with the reduction in mortgage term and the amount of interest you could save by overpayment.

Highlights:

- Overpayment Type: Recurring overpayments.

- Stats: New monthly repayment, interest savings, and mortgage term reduction.

- Mortgage Comparison: No comparison.

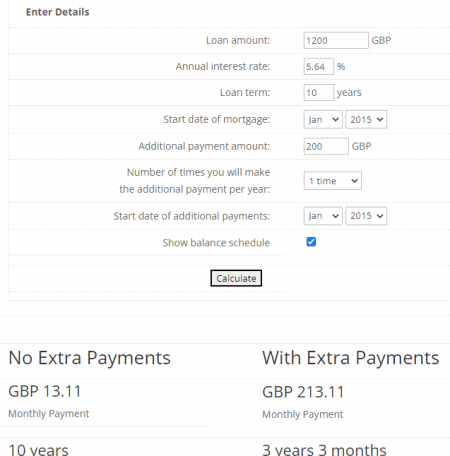

StannardMcMahon.co.uk

StannardMcMahon.co.uk offers yet another free online mortgage overpayment calculator. If you want to pay a specific number of additional payments toward your mortgage loan then this is the calculator you can use. Simply fill in your mortgage information and then select how many additional payments you want to make. Enter the payment amount and select the start date of the additional payment. When you run the calculator, it shows you the monthly payment, mortgage term, and interest for current payments and additional payments. It also generates a yearly payment schedule where you can check the impact of additional payments over the years.

Highlights:

- Overpayment Type: Additional overpayment.

- Stats: New monthly repayment, mortgage term, interests, and savings with additional overpayments.

- Mortgage Comparison: Yearly payment schedule table.

NicolaAmidullaMortgages.co.uk

NicolaAmidullaMortgages.co.uk is a free website where you can calculate mortgage overpayment online. This calculator works for repayment mortgages and interest mortgages. Depending on what you seek with the overpayment, you go with the respective mortgage option. In either case, you can add the additional amount you want to pay per month over the current monthly repayment. It does not support one-time payments or lump sum payments. After the calculations, the calculator gives you the potential interest saving, new monthly payment, and mortgage term reduction or mortgage balance reduction. It also generates a chart and table comparing the mortgages with and without overpayment.

Highlights:

- Overpayment Type: Recurring monthly overpayments (for repayment or interest).

- Stats: New monthly repayment, potential interest saving, potential mortgage reduction (for repayment), and potential repayment decrease (for interest).

- Mortgage Comparison: Chart and Table comparison of remaining years of repayments.

About Us

We are the team behind some of the most popular tech blogs, like: I LoveFree Software and Windows 8 Freeware.

More About UsArchives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014