10 Best Free Online VAT Calculator Websites

Here is a list of best free online VAT calculator websites. VAT or Value Added Tax is a type of consumption tax applied to various goods and services. In some countries, it is also known as GST or Goods and Services tax. To calculate the VAT amount, Net Amount, Gross Amount, etc., values, users can use these online VAT calculator websites. To perform the calculation, users need to enter input values like Initial Amount, VAT Rate (%), etc., Besides this, users can also include and exclude the VAT in some websites to generate Net and Gross amounts.

The process to perform VAT calculations is quite simple on all these websites. Still, I have included the necessary calculation steps in the description of each website. After performing the calculation, users can copy and save the final result. Through some websites, users can even share the link of output with other users.

These websites also come with many additional calculators and tools that may come in handy. Using additional tools, users can calculate discount, mortgage, rent, loan, etc., parameters. Go through the list to know more about these websites.

My Favorite Online VAT Calculator Website:

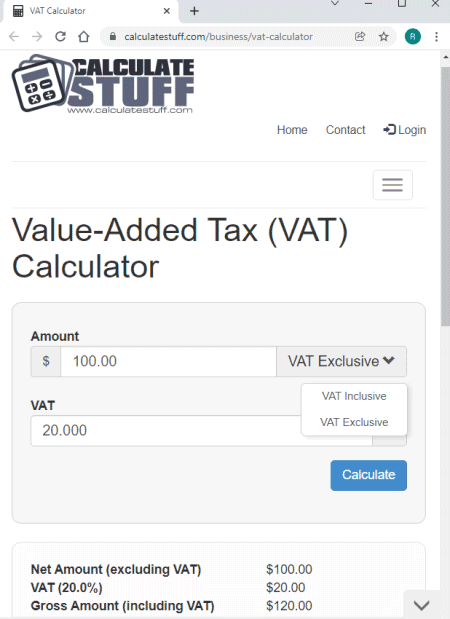

calculatestuff.com is my favorite website as it can easily calculate both Gross and Net amounts. Plus, it lets users include or exclude the VAT from the calculation.

You can also check out lists of best free Online Dew Point Calculator, Online Arithmetic Progression Calculator, and Online Heat Index Calculator websites.

calculatestuff.com

calculatestuff.com is a free online VAT calculator website. This website offers a simple value-added tax calculator that can calculate the Net Amount excluding VAT and Gross amount including VAT. It also gives users the ability to set custom VAT percentages according to requirements. After the calculation, it also provides a sharable URL to share the final result with other users. Now, check out the below steps.

How to perform VAT calculation online using calculatestuff.com:

- Visit this website and enter the initial amount value.

- Now, include or exclude VAT according to the output you are expecting (Net amount or Gross Amount).

- Lastly, specify the VAT percentage and hit the Calculate button.

Additional Features:

- This website also offers useful online calculators such as Mortgage Calculator, Auto Loan Calculator, BMI Calculator, Discount Calculator, and more.

Final Thoughts:

It is one of the best free online VAT calculator websites that anyone can use to calculate the Gross and Net amount for different VAT percentages.

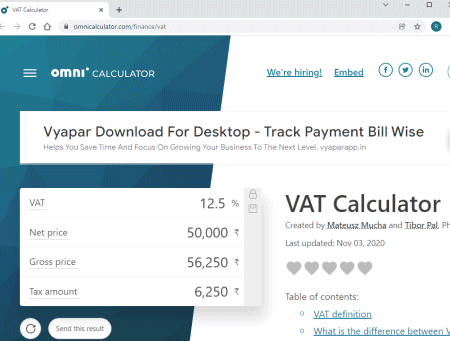

omnicalculator.com

omnicalculator.com is a free online universal calculator website that offers a lot of online calculators covering various fields such as Math, Physics, Chemistry, Health, and more. To perform the VAT calculations, it offers a dedicated VAT calculator tool. Using this tool, users can find out the Net Price, Gross Price, and Tax Amount. Besides this, it also lets users manually specify the VAT percentage. Now, follow the below steps to perform VAT calculation using this website.

How to perform VAT calculation online using omnicalculator.com:

- Start this website and open up the VAT calculator.

- After that, enter the VAT percentage and enter Net Price to find out the Gross Price and Tax amount.

- Now, users can specify the Gross Price to find out the Net Price and Tax Amount.

Additional Features:

- VAT Information: This website also offers a good set of VAT information such as VAT Definition, difference between GST and Sales, Margin and VAT Procedure, and more.

- Additional Calculators: Many useful calculators such as GST, Sales Tax, Sales, Optimal Price Calculator, etc., are also present in it.

Final Thoughts:

It is another good online universal calculator website through which users can calculate Net Price, Gross Price, and Tax Amount.

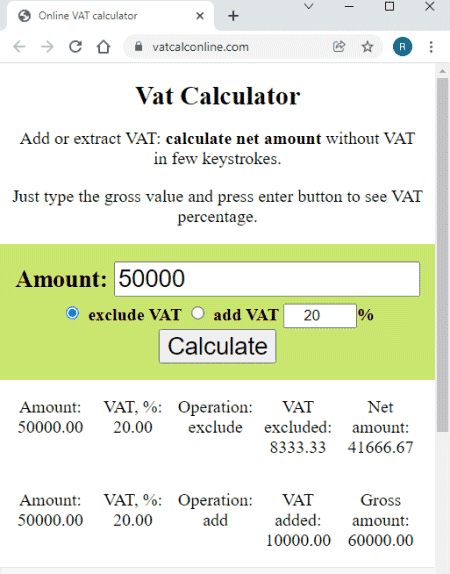

vatcalconline.com

vatcalconline.com is a free online VAT calculator website. Using this website, users can calculate the net amount without including the VAT. It can also calculate the gross amount with added VAT. It also lets users manually add the VAT percentage before starting the calculation process. Now, follow the below steps to calculate VAT online using this website.

How to perform VAT calculation online using vatcalconline.com:

- Visit this website using the provided link.

- After that, specify the initial amount in the Amount field.

- Now, exclude or include VAT using available options.

- Now, hit the Calculate button to view the Gross amount with added VAT or Net Amount with excluded VAT.

Additional Feature:

- This website also has VAT calculation steps on its interface to help out new users.

Final Thoughts:

It is a simple online VAT calculator website that can calculate and find both Net and Gross amounts.

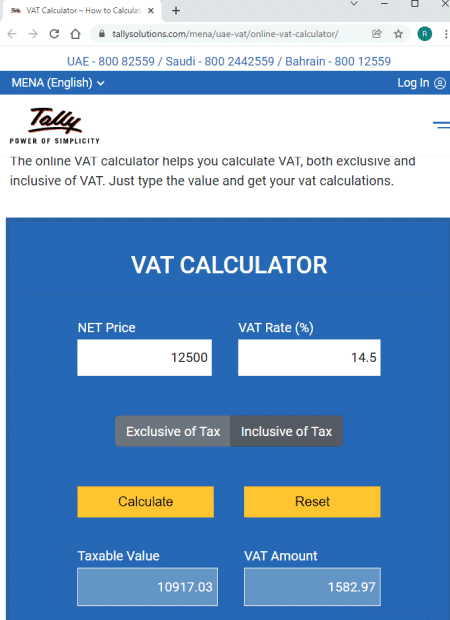

tallysolutions.com

tallysolutions.com is another free online VAT calculator website. Through this website, users can calculate the Taxable Value and VAT Amount for both cases (including tax and excluding tax). To perform the calculation, users need to enter NET Price and VAT Rate percentage. This website also answers various questions related to VAT and how it works. Now, follow the below steps to calculate VAT using this website.

How to perform VAT calculation online using tallysolutions.com:

- Start this website and visit the VAT Calculator.

- Now, enter the NET Price and VAT Percentage values.

- Next, choose either Exclusive of Tax or Inclusive of Tax option.

- Lastly, click on the Calculate button to start the calculation process and get the final values.

Additional Features:

- This website also offers many Tally products and services such as TallyPrime, TallyPrime Server, TSS, and more.

Final Thoughts:

It is another capable online VAT calculator website that anyone can use to perform VAT calculations.

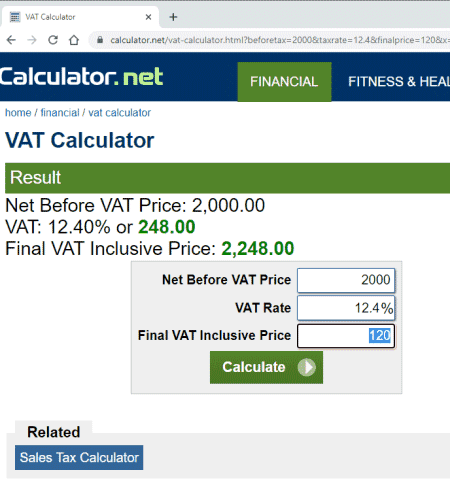

calculator.net

calculator.net is yet another free online VAT calculator website. This website is specially designed to find out the VAT amount and final VAT Inclusive Price. To do the calculation, users need to enter the values of three parameters namely Net Before VAT Price, VAT Rate, and Final VAT Inclusive Price. It also answers various questions associated with VAT on its interface such as What is VAT, VAT Differences between Countries, VAT vs Sales Tax, and more. Now, check out the below steps.

How to perform VAT calculation online using calculator.net:

- Launch this website using the given link.

- After that, enter the values of Net Before VAT Price, VAT Rate, and Final VAT Inclusive Price.

- Now, hit the Calculate button to initiate the calculation process.

Additional Features:

- This website offers many additional financial calculators such as Rent Calculator, Mortgage Calculator, APR Calculator, Down Payment Calculator, Rental Property Calculator, and more.

Final Thoughts:

It is another good online VAT Calculator website through which users can find out VAT Amount and Final VAT Inclusive Price.

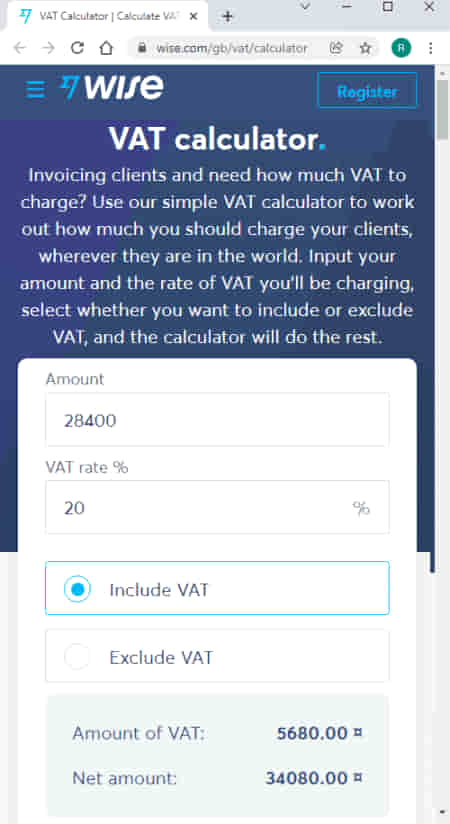

wise.com

wise.com is another free online VAT calculator website. This online calculator can find out the Net Amount and Amount of VAT values after the calculation. The good thing about this calculator is its ability to perform VAT calculations by including or excluding the VAT. Now, to perform the calculation, users need to enter the initial Amount and VAT Rate Percentage. Now, check out the below steps to calculate VAT online.

How to perform VAT calculation online using wise.com:

- Go to this website and enter the initial Amount value.

- After that, specify the VAT rate percentage.

- Now, users can choose to Include or Exclude the VAT.

- Lastly, view the output VAT Amount and Net Amount values.

Additional Features:

- VAT Rates of Countries: On this website, users can find out the VAT rates of various EU and NON-EU countries.

- This website also offers advanced Money Transfer and Multi-Currency Account services.

Final Thoughts:

It is another good online VAT calculator website that offers all the essential tools to perform VAT calculations.

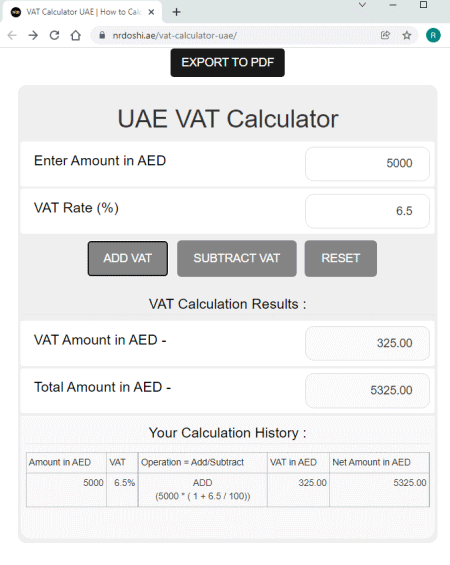

nrdoshi.ae

nrdoshi.ae is another free online VAT calculator website. This website is mainly designed to perform VAT calculations for UAE businesses. To perform the calculation, users just need to enter Initial Amount and VAT Rate percentage values. Plus, it also lets users Add and Subtract VAT. According to the input values, this calculator performs the calculation and shows the output VAT Amount and Total Amount. Now, follow the below steps.

How to perform VAT calculation online using nrdoshi.ae:

- Launch this website using the given link.

- After that enter the input initial amount and VAT Percentage values.

- Next, Add or Subtract the VAT to start the calculation process.

- Lastly, view the calculated amount.

Additional Feature:

- Export to PDF: Use it to export the calculated VAT amount as PDF.

Final Thoughts:

It is a simple-to-use online VAT calculator that anyone can use with ease.

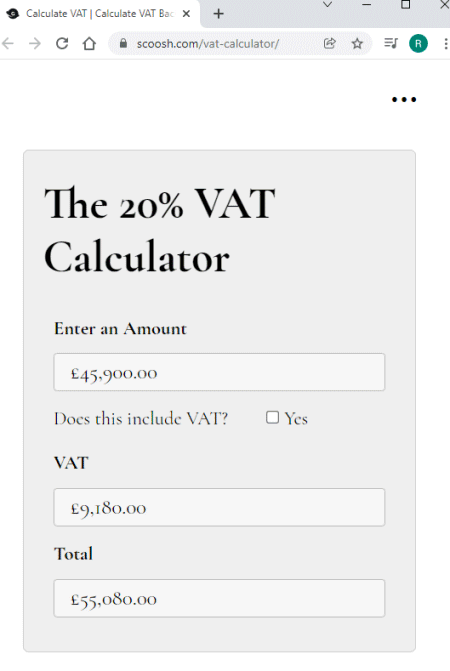

scoosh.com

scoosh.com is another free online VAT calculator website. Using this website, users can calculate VAT forward and Backward only at a fixed percentage(20 percent). It also lets users completely remove VAT from the calculation. On its interface, users can also find various examples of VAT calculations. Now, follow the below steps to perform VAT calculations using this website.

How to perform VAT calculation online using scoosh.com:

- Launch this website and enter the initial amount in the Amount field.

- Next, specify whether you want to include VAT or not.

- Lastly, view the calculated VAT amount and total amount.

Limitation:

- This website doesn’t allow users to change the VAT percentage.

Final Thoughts:

It is a decent online VAT calculator website that users can try if they only want to calculate VAT at a fixed VAT rate percentage.

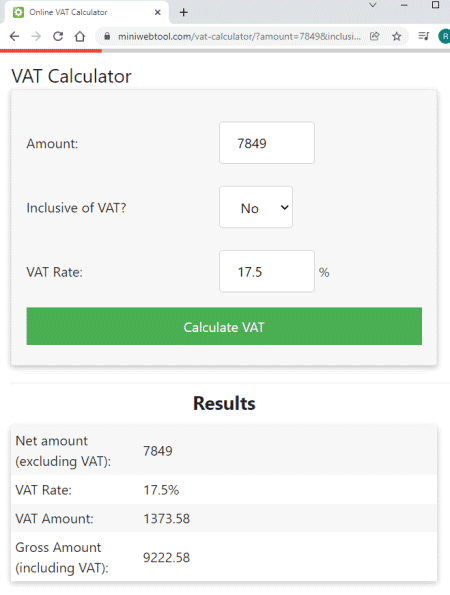

miniwebtool.com

miniwebtool.com is another free online VAT calculator website. This website uses the initial amount and VAT rate percentage to find out the Net Amount, Gross Amount, and VAT amount. By including the VAT, users can find out the Gross amount. By excluding the VAT, users can find out the Net amount. Now, follow the below steps.

How to perform VAT calculation online using miniwebtool.com:

- Launch this website and enter the initial amount value.

- Now, include or exclude the VAT.

- Next, specify the VAT rate percentage.

- Lastly, hit the Calculate VAT button to view the calculated values.

Additional Features:

- This website offers multiple online tools such a Random Name Picker, Sum Calculator, Sort Numbers, Ovulation Calendar, and more.

Final Thoughts:

It is another capable yet simple to use online VAT calculator that comes with all the essential VAT calculation tools.

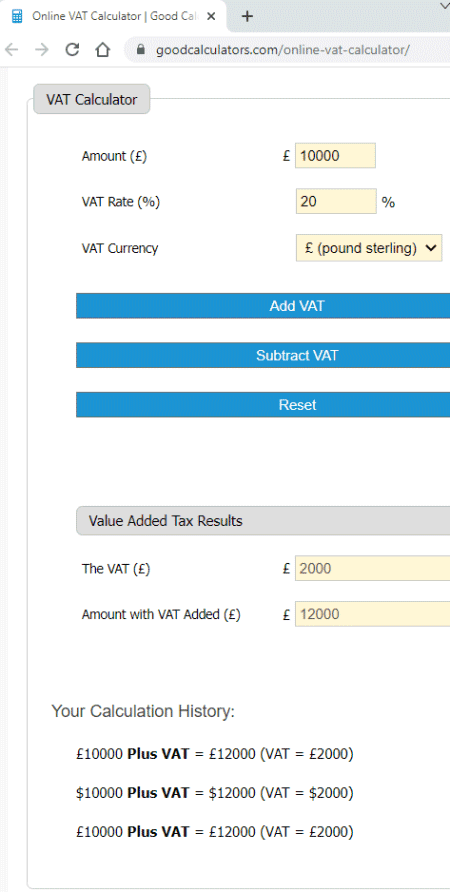

goodcalculators.com

goodcalculators.com is another free online VAT calculator website. As the name of this website implies, it offers multiple online calculators one of which is an online VAT calculator. This calculator uses Amount, VAT Rate, and VAT Currency type (pound, dollar, and euro) to calculate the VAT amount and amount with added VAT. It also gives users an option to add and subtract VAT amount. Now, follow the below steps.

How to perform VAT calculation online using goodcalculators.com:

- Launch this website and access its online VAT calculator.

- Now, enter the Amount, VAT Rate (%), and VAT Currency type.

- Next, choose the Add or Subtract VAT option to start the calculation and view the output VAT amount and Total amount.

Additional Features:

- On this website, users can also find useful calculators such as Retirement Calculator, Mortgage Calculator, Contractor Calculator, Loan Calculator, and more.

Final Thoughts:

It is another good online VAT calculator website through which users can calculate VAT amount and amount with added VAT.

Naveen Kushwaha

Passionate about tech and science, always look for new tech solutions that can help me and others.

About Us

We are the team behind some of the most popular tech blogs, like: I LoveFree Software and Windows 8 Freeware.

More About UsArchives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014