7 Best Free Online Cash Flow Calculator Websites

Here is a list of best free online cash flow calculator websites. The flow of money in and out of a business within a certain time is referred to as cash flow. When more money is coming into a business than going out is referred to as positive cash flow. On the other hand, if more money is going out than coming into a business is known as negative cash flow. It is an important financial metric as it indicates the financial health of a business. Businesses with positive cash flow are considered healthy businesses. To calculate the cash flow of a business, users need these online cash flow calculator websites.

Through these websites, users can calculate the net cash flow of a business. Some of these websites also show the actual cash flow status of a business in terms of negative and positive. To perform the calculation, users need to enter the cash inflow and cash outflow amount due to different entities of a business. Based on the cash inflow and cash outflow values, it calculates and shows the net cash flow of a business. To help out users, I have included the steps to calculate cash flow in the description of each website.

These websites also offer additional business calculators such as Value Added Tax, Sales Tax, Break-Even, Current Cash Flow, Leverage Ratios, and more. Go through the list to learn more about these websites.

My Favorite Online Cash Flow Calculator Website:

360financialliteracy.org is my favorite website as it can calculate the net cash flow of a business and generate a beginning vs. end cash graph.

You can also check out lists of best free Online Actual Cash Value Calculator, Online Reducing Interest Rate Calculator, and Online CTR Calculator websites.

Comparison Table:

| Features/Website Names | Calculates net cash flow | Generates cash flow graph or charts | Can also perform personal cash flow calculation |

|---|---|---|---|

| 360financialliteracy.org | ✓ | ✓ | x |

| waveapps.com | ✓ | x | x |

| mdm.ca | x | x | ✓ |

| bplans.com | ✓ | ✓ | x |

| shopify.com | ✓ | x | x |

| omnicalculaor.com | ✓ | x | x |

| calculators.org | ✓ | x | x |

360financialliteracy.org

360financialliteracy.org is a free online cash flow calculator website. This website helps users calculate the cash flow of their business operations. It can calculate both the negative and positive cash flows. To do that, it requires some values from users namely cash at the beginning of a period, cash flow from operations, cash flow from investments, and cash flow from financing. After performing the calculation, it shows the cash at the end of a period. A bar graph highlighting the cash at the beginning vs. cash at the end of a period is also provided.

This website also provides the definitions of terms used in this cash flow calculator like cash at the beginning of a period, received from customers, for insurance, sales, purchases, etc. A detailed cash flow report is also generated by it, which can be printed and saved in PDF format. Now, follow the below steps.

How to perform cash flow calculations online using 360financialliteracy.org:

- Go to this website and access the cash flow calculator.

- After that, enter the cash at the beginning of a period in US dollars.

- Now, specify cash flow from operations, investments, and financing aspects.

- Finally, view the calculated cash at the end of a period with a detailed cash flow report.

Additional Features:

- This website also has additional tools such as 1040 Tax Calculator, 401k Savings Calculator, 457 Savings Calculator, Asset Allocator, and more.

Final Thoughts:

It is one of the best free online cash flow calculator websites through which users can calculate the cash flow of a business operation.

| Pros | Cons |

|---|---|

| Generates a detailed cash flow report | |

| Generates a beginning vs. ending cash flow bar graph |

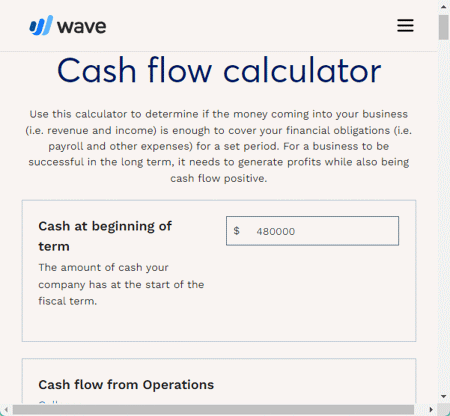

waveapps.com

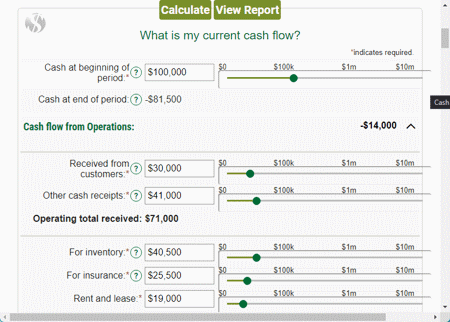

waveapps.com is another free online cash flow calculator website. Through this website, users can determine the amount of money coming into their business and whether it is enough to cover all their financial obligations. To perform the calculation, users need to specify the cash at the beginning of a term, cash flow from operations (received from customers and other ash receipts), cash flow from investments (sale, capital expenditures, and other activity), and cash flow from financing (new borrowing, stock issuing, loan repayments, etc.). After performing the calculation, it shows the cash at the end of the term. If the cash at the end term is higher than the cash at the beginning then it is termed as positive cash flow. On the other hand, if the cash at the end term is lower than the cash at the beginning then it is termed as negative cash flow. Now, follow the below steps.

How to perform cash flow calculations online using waveapps.com:

- Go to this website using the given link.

- After that, specify cash at the beginning of the term, cash flow from operations, cash flow from investments, and cash flow from financing.

- Next, view the calculated cash at the end of the term in US dollars.

Additional Features:

- This website also comes with invoicing, accounting, and payroll tools and services.

Final Thoughts:

It is another good online cash flow calculator website that offers all the tools to calculate the cash at the end of the term.

| Pros | Cons |

|---|---|

| Calculates cash at the end of the term |

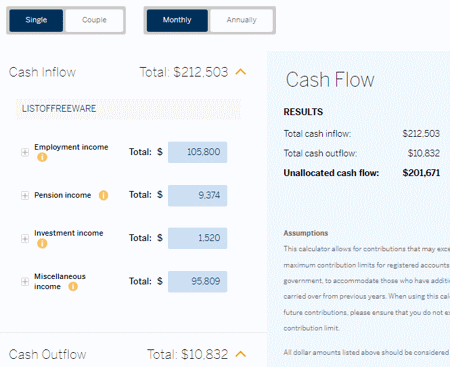

mdm.ca

mdm.ca is another free online cash flow calculator website. Through this website, users can calculate monthly and yearly personal cash flow. However, an option to calculate the cash flow for couples is also provided. In this calculator, users can divide cash inflow and cash outflow into multiple categories and subcategories such as Employment Income (Salary, Bonus, etc.), Pension Income (old age security benefits, CPP benefits, etc.), Investment Income (Interests, Dividends, Capital Gains, etc,), Source Deductions (CPP Contributions, union dues, etc,), Family & Living (groceries, clothing, bills, etc.), Transportation, Accommodation, Personal Expenditures, etc. Based on all the specified monetary values, users can view their monthly and yearly cash inflow and cash outflow amounts in US dollars. Now, follow the below steps.

How to perform cash flow calculation online using mdm.ca:

- Visit this website and choose either a single (for personal cash flow calculations) or a couple (for cash flow calculations of a couple) option.

- Next, select the monthly (to calculate monthly cash flow) or annually (to calculate annual cash flow) option.

- Now, manually submit all the cash inflow and cash outflow monetary values.

- Finally, view the calculated cash inflow amount, cash outflow amount, and unallocated cash flow amount in US dollars.

Additional Features:

- This website also offers financial advice to users based on their cash inflow and cash outflow values.

Final Thoughts:

It is another good online cash flow calculator website that can be used to perform personal cash flow calculations.

| Pros | Cons |

|---|---|

| Can be used to perform personal cash flow calculations | |

| Calculates cash inflow and cash outflow amount |

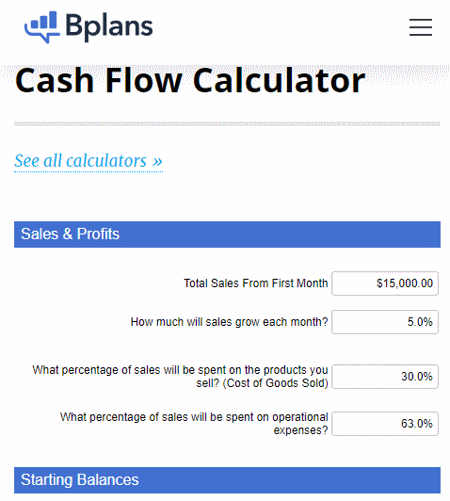

bplans.com

bplans.com is a free online cash flow calculator website. Through this website, users can calculate the yearly cash flow of a business. To do that, it covers three main parameters namely Sales & Profit, Starting Balances, and Cash Payment Delays. Each of the three main parameters has multiple sub-parameters that users need to submit to perform the calculation. After the calculation, users will get cash balance, accounts payable, accounts receivable, and inventory on hand values. It also generates a month-wise cash vs. profits graph. Now, follow the below steps. Now, follow the below steps.

How to perform cash flow calculation online using bplans.com:

- Go to this website and access the cash flow calculator.

- After that, manually enter all the parameters of sales & profit, starting balances, cash payment delays sections.

- Next, view the calculated cash balance, accounts payable, accounts receivable, and inventory on hand values.

Additional Features:

- On this website, users can also find a handy online break-even calculator tool.

Final Thoughts:

It is another simple and effective online break-even calculator website that anyone can use with ease.

| Pros | Cons |

|---|---|

| Generates a profit vs. cash graph |

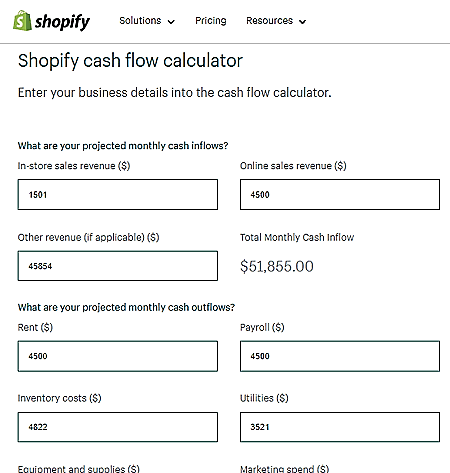

shopify.com

shopify.com is another free online cash flow calculator website. Through this website, users can calculate the cash flow of a business. It also highlights whether the cash flow is negative or positive. To perform the calculation, users need to enter monthly cash inflows (in-store sales revenue, online sales revenue, and other revenue ) and monthly cash outflow (rent, payroll, utilities, marketing spending, etc.) values. Based on the provided values, it shows the net cash flow in US dollars. Now, follow the below steps.

How to perform cash flow calculation online using shopify.com:

- Visit this website and access the shopify cash flow calculator.

- After that, enter the values of all cash inflow parameters.

- Next, enter the values of all cash outflow parameters.

- Finally, click on the Calculate button to view the net cash flow and cash flow status (negative or positive).

Additional Features:

- This website also offers multiple online services like shipping, order tracking, online store editor, store themes, domains & hosting, and more.

Final Thoughts:

It is another capable online cash flow calculator website that offers all the tools to find out the net cash flow of a business.

| Pros | Cons |

|---|---|

| Calculates net cash flow | |

| Show cash flow status (negative or positive) |

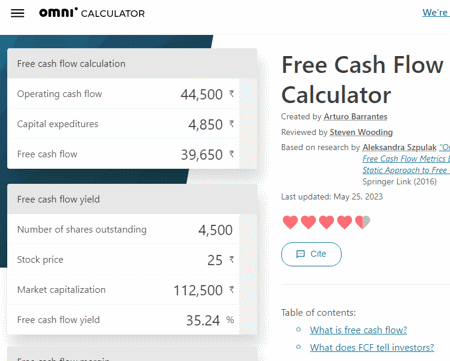

omnicalculaor.com

omnicalculaor.com is another free online cash flow calculator website. Through this website, users can quickly perform cash flow, cash flow yield, and cash flow margin values. Plus, it allows users to calculate all three parameters of a cash flow calculation namely operating cash flow, capital expenditures, and free cash flow. By entering the values of any two of the three cash flow calculation parameters, users can find out the third parameter.

This website explains cash flow in detail. It also shows the cash flow formula and explains all its parameters. Steps to calculate free cash flow with real examples are also provided by it. Now, follow the below steps.

How to perform cash flow calculation online using omnicalculator.com:

- Launch this website using the given link.

- After that, enter any two parameters of cash flow calculation to find the third one.

- Next, view and copy the calculated cash flow calculation parameter.

Additional Features:

- This website also offers a good set of related calculators such as FCFF, Net Debt, Net Profit Margin, Productivity, Sales, Total Asset Turnover, etc.

Final Thoughts:

It is a feature-rich online cash flow calculator website that can calculate all three cash flow parameters namely operating cash flow, capital expenditures, and free cash flow.

| Pros | Cons |

|---|---|

| Calculates all three cash flow calculation parameters |

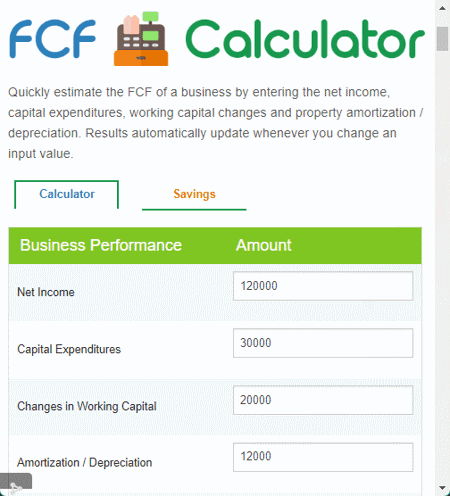

calculators.org

calculators.org is another free online cash flow calculator website. This website offers a free cash flow calculator that helps users find out the present value of a business. To calculate the free cash flow of a business, it needs four input values namely Net Income, Capital Expenditures, changes in Working Capital, and Amortization/ Depreciation value. It also shows the formula that it uses to calculate the free cash flow. It also highlights the importance and significance of free cash flow amount. Now, follow the below steps.

How to calculate free cash flow online using calculators.org:

- Launch this website and access the FCF calculator.

- After that, enter the net income, capital expenditures, changes in working capital, and amortization values.

- Next, click on the calculate button to view the free cash flow amount that can be negative or positive highlighting the present value of a business.

Additional Features:

- This website offers handy business calculators such as Value Added Tax, Sales Tax, Break-Even, Current Cash Flow, Leverage Ratios, Best Tax Back, and more.

Final Thoughts:

It is a good online free cash flow calculator that helps users find out the valuation of a business, unlike cash flow calculators that help users calculate the actual net cash inflow of a business.

| Pros | Cons |

|---|---|

| Calculates the free cash flow of a business | Cannot calculate the cash flow of a business |

Frequently Asked Questions

Cash flow is calculated by analyzing the inflow and outflow of cash from a business or individual's financial activities over a specific period. The formula for calculating cash flow is: Cash Flow = Net Income + Non-Cash Expenses - Changes in Working Capital.

Cash flow analysis helps assess the financial health of a business or individual. It provides a clear picture of whether there is more cash coming in than going out (positive cash flow) or the reverse (negative cash flow). A positive cash flow is typically a sign of financial stability, while a negative cash flow can indicate financial trouble.

The three main types of cash flows are: Operating Cash Flow (OCF), Investing Cash Flow (ICF), and Financing Cash Flow (FCF). The operating cash flow represents the cash generated or used by a company's core business operations. It reflects the cash inflows and outflows resulting from the company's day-to-day activities, such as selling products or services. The investing cash flow represents the cash flows related to investments in long-term assets or investments in other companies. It reflects the cash inflows and outflows associated with buying and selling assets that are not part of the day-to-day operations. The financing cash flow tracks the cash flows related to financing activities, primarily involving the company's sources of capital and debt. It reflects the cash inflows and outflows associated with raising or repaying capital and debt.

No, cash flow is not the same as profit (also known as net income or earnings). They are distinct financial metrics, and understanding the difference between them is crucial for assessing the financial health of a business or individual.

Cash flow refers to the movement of money into and out of a business or individual's finances over a specific period of time. It represents the actual cash (physical currency, checks, electronic funds, etc.) that flows in and out of an entity's financial accounts, indicating how much cash is generated or spent during that period.

Naveen Kushwaha

Passionate about tech and science, always look for new tech solutions that can help me and others.

About Us

We are the team behind some of the most popular tech blogs, like: I LoveFree Software and Windows 8 Freeware.

More About UsArchives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014