9 Best Free Online Reducing Interest Rate Calculator Websites

Here is a list of the best free online Reducing Interest Rate Calculator websites. A reducing interest rate decreases over time as the outstanding loan principal reduces with each payment. It is also known as a diminishing balance interest rate. In reducing balance interest rate loans, the interest is calculated on the remaining amount at any time. Whereas, in flat interest rate loans, the interest is calculated on the initial principal amount throughout the tenure.

Reducing interest rate is generally better for loan borrowers. With a reducing interest rate, you will have to pay overall less interest thus saving over a flat interest rate. This post covers 9 free websites that can help you calculate reducing interest rates with ease. You can compare the same loan amount, tenure, and interst for both types of interest rates and see the difference.

My Favorite Online Reducing Interest Rate Calculator

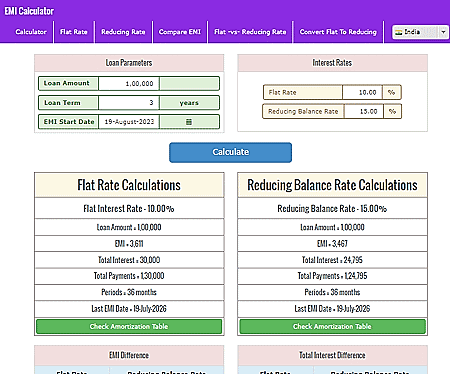

EMI-Calc.com is my favorite website on this list for online reducing interest rate calculation. The calculator compares the flat rate calculations and reducing balance rate calculations side by side. It gives you a breakdown of total savings down to each EMI payment. It also generates repayment charts visually comparing the total interest to be paid in each case.

You can check out our other lists of the best free Online Payback Period Calculator Websites, Online Piggyback Loan Calculator Websites, and Online Mortgage Overpayment Calculator Websites.

Comparison Table:

| Name | Total Interest/Payment | EMI Calcuation | Flat vs Reducing Comparison | Chart / Table |

|---|---|---|---|---|

| EMI-Calc.com | ✓ | ✓ | ✓ | Principal+Interest Chart |

| Trinkerr.com | ✓ | ✓ | ✓ | x |

| Groww.in | ✓ | ✓ | ✓ | Flat vs Reducing Graph |

| CashKumar.com | ✓ | ✓ | ✓ | x |

| GetMoneyRich.com | ✓ | ✓ | ✓ | x |

| FundsTiger.in | ✓ | ✓ | ✓ | Replayment Schedule |

| Zebuetrade.com | ✓ | ✓ | ✓ | x |

| TheMunim.com | ✓ | ✓ | ✓ | x |

| Deal4Loans.com | ✓ | ✓ | x | Principal+Interest Chart |

EMI-Calc.com

EMI-Calc.com provides financial calculators for EMI and amortization. The website allows you to calculate EMI for different types of loans, such as flat rate, reducing balance, and moratorium. In the case of interest rates, this website offers a Flat Rate Calculator, a Reducing Rate Calculator, and a Flat -vs- Reducing Rate Calculator. You can click-open any of the calculators and use that to perform your calculation. The Flat -vs- Reducing Rate Calculator combines the other two into a single calculator. You can simply add your loan details and provide the flat rate and reducing balance rate. With that, the calculator side-by-side comparison of both types of rates. It compares the EMIs of both calculates and shows the EMI difference. At the end of the comparison, you get a visual representation of the calculations showing principal and interest charts for both calculations.

How to calculate reducing interest rate online using EMI-Calc.com?

- Enter the Loan Amount, Loan Term, and EMI Start Date into the respective sections.

- Then provide the Flate Rate and Reducing Balance Rate.

- Click the Calculate button to get the flat vs. reducing comparison.

Highlights:

- Output: EMI, Total Interest, and Total Payments.

- EMI Calculation: Monthly EMI with Last EMI Date.

- Comparison: Flat Rate vs. Reducing Balance Rate comparison.

- Same/Different Rates: Options to set Flat and Reducing rates separately.

- Additional Feature(s): Plots repayment charts with Principal and Interest.

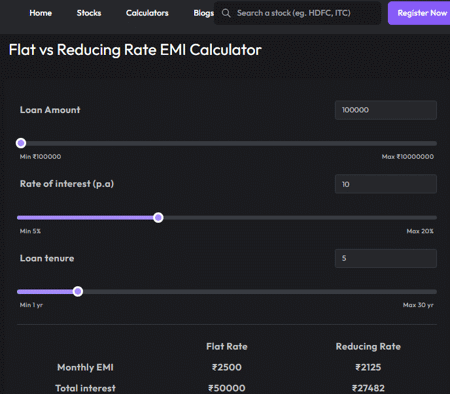

Trinkerr.com

Trinkerr.com is a social trading platform that aims to educate and empower investors in India. The website packs several finance calculators that you can use for free. Under the EMI calculators, it has a Flat vs Reducing Rate EMI Calculator. This calculator compares the flat rate and reducing rate for a given loan. All you have to do is provide the loan details covering Loan Amount, Rate of Interest, and Loan Tenure. The calculator uses the same rate of interest for both calculations and shows the results right away. You can make changes to input at any time and the calculators adjust the calculations for that in real-time.

How to calculate reducing interest rate online using Trinkerr.com?

- Add your Loan Amount, Rate of Interest, and Loan Tenure into the respective boxes. You can also use the respective sliders to set these values.

- When you do that, the calculator updates the output below covering Monthly EMI, Total Interest, and Total Amount.

Highlights:

- Output: Monthly EMI, Total Interest, and Total Amount.

- EMI Calculation: Monthly EMI.

- Comparison: Shows output for Flat Rate and Reducing Rate.

- Same/Different Rates: It uses the same Rate of Interest for Flat Rate and Reducing Rate.

- Additional Feature(s): N/A.

Groww.in

Groww.in is an online platform that offers various financial services such as demat, trading, mutual fund investment, loans, etc. You can use their website to explore different financial products, calculators, tools, and resources. Among the calculators, it offers a Flat vs Reducing Rate Calculator. This calculator lets you calculate the reducing balance rate and compares it to a flat rate for the same interest rate. The calculator works almost instantly. As you make any changes to the inputs, it changes the output to reflect the correct output. You can use this calculator to compare EMIs, total interests, and total amounts for both rate types.

How to calculate reducing interest rate online using Groww.in?

- Go to this calculator and type in your Loan Amount, Rate of Interest (per annum), and Loan Tenure (years/months).

- As you change the value, the calculator instantly updates the results reflecting your calculation. It shows Monthly EMI, Total Interest, and Total Amount. for flat rate and reducing rate.

Highlights:

- Output: Monthly EMI, Total Interest, and Total Amount.

- EMI Calculation: Monthly EMI.

- Comparison: Calculates for Flat Rate and Reducing Rate.

- Same/Different Rates: Use the same Flat rate and Reducing Rate in the calculation.

- Additional Feature(s): Principal+Interest chart for Flat Rate and Reducing Rate.

CashKumar.com

CashKumar.com is a peer-to-peer lending platform that offers instant personal loans to salaried professionals. Alongside their prior business, the website features many online calculators for finance. It has a Flat Interest Rate vs Reducing Balance Interest Rate Calculator. This calculator helps you compare the Flat Interest Rate to Reducing Balance Interest Rate and know the difference in EMI payments and savings on your loans. All you have to do is enter your loan details along with the flat rate and reducing balance rate. Then the calculator gives you a breakdown of the loan amount calculating total interest and monthly EMIs.

How to calculate reducing interest rate online using CashKumar.com?

- Visit the link given below to open this calculator in your browser.

- Enter the Loan Amount and Loan Tenure (years/months).

- Then set the Flat Rate Interest and Reducing Balance Rate to get the output.

Highlights:

- Output: EMI, Total Interest, Total Payments, and Total Savings.

- EMI Calculation: Monthly EMI.

- Comparison: Flat Rate vs. Reducing Balance Rate comparison.

- Same/Different Rates: Options to set Flat and Reducing rates separately.

- Additional Feature(s): N/A.

GetMoneyRich.com

GetMoneyRich.com is a personal finance blog that provides information and guidance on various topics such as stock analysis, mutual funds, income, loans, spending, etc. There is a blog on the website titled “Reducing Balance Method of Loan Calculation: Online Calculator & Excel Working”. This blog includes a Reducing Balance Loan Calculator and a Fixed Interest Loan Calculator. You can use both of these calculators to calculate the total payment, total interest, and monthly EMI of a loan. Both calculators as separate, and you can carry out the same or different calculations in them.

How to calculate reducing interest rate online using GetMoneyRich.com?

- Scroll down to the Reducing Balance Loan Calculator section.

- Add your Principal Loan Amount, Interest Rate, and Time (in months).

- Then click the Calculate button to get the payment calculations.

- Below that, you can do the same for the Fixed Interest Loan Calculator.

Highlights:

- Output: Total Interest, Total Payments, and Monthly EMI.

- EMI Calculation: Yes, it calculates monthly EMI.

- Comparison: Flat Rate vs. Reducing Balance Rate comparison.

- Same/Different Rates: Separate calculators.

- Additional Feature(s): N/A.

FundsTiger.in

FundsTiger.in is an online loan platform that provides various types of loans for personal, family, or business purposes. Their website features this really good Flat Rate Vs Reducing Rate Calculator. This calculator has an input section at the top. You can add your loan information to the calculator and flat rate and reducing rate separately. When you run the calculator, it shows the results for flat and reducing rates side by side. You can see the EMI difference, total interest, and total amount. Along with that, you can also set the starting date of the EMIs so that you can know the exact ending date of the EMIs. This calculator also generates Repayment Schedule tables for flat rate as well as reducing rate. This lets you track all the EMIs along with Principle Dues Remaining with each EMI.

How to calculate reducing interest rate online using FundsTiger.in?

- Use the link added below to visit this calculator online.

- Enter your inputs including Loan Amount, Loan Term (in months), Flat Rate (per month), and Reducing Rate (per month).

- Also, set the Starting Date of EMI.

- After that, click the Calculate button to get results.

Highlights:

- Output: EMI, Total Interest Paid, and Total Amount Paid.

- EMI Calculation: Calculates EMI for Flat Rate and Reducing Rate.

- Comparison: Flat Rate vs. Reducing Balance Rate side-by-side comparison.

- Same/Different Rates: Separate Flat Rate and Reducing Rate inputs.

- Additional Feature(s): Repayment Schedule Tables for Flat Rate and Reducing Rate.

Zebuetrade.com

Zebuetrade.com is an online stock broking and trading platform that offers various financial services such as demat, trading, mutual funds, IPOs, etc. The website features various blogs and calculators as well. A Flat & reducing interest calculator is one of the calculators that you can use on the website. This is a simple calculator that calculates the loan payment and interest for flat rate as well as a reducing rate. All you have to do is enter the Loan Amount, Interest Rate (p.a.), and Tenure Period into the calculator. Then it compares the Monthly EMI, Total interest, and total payment in each case.

How to calculate reducing interest rate online using Zebuetrade.com?

- Head over to this online calculator using the link given below.

- Add the Loan Amount, Interest Rate (p.a.), and Tenure Period into the calculator.

- This gets you the Flat Rate and Reducing Rate calculations.

Highlights:

- Output: Monthly EMI, Total Interest, and Total Amount.

- EMI Calculation: Calculates monthly EMI.

- Comparison: Side-by-side Flat Rate and Reducing Rate calculation comparison.

- Same/Different Rates: It uses the same interest rate for both calculations.

- Additional Feature(s): N/A.

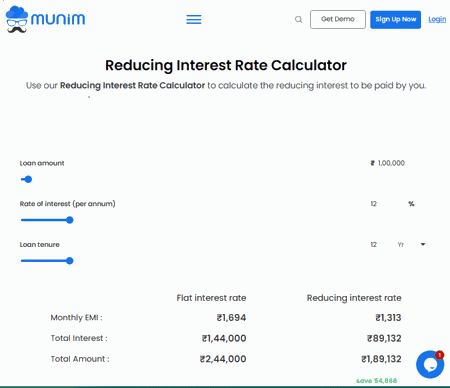

TheMunim.com

TheMunim.com is an online accounting and e-invoicing software that offers many other services and accounting features. Their website has a Reducing Interest Rate Calculator that you can use to calculate the reducing interest to be paid by you. The calculator asks you to fill in the Loan Amount, Rate of Interest per annum, and Loan Tenure in years or months. When you do that, it shows the Monthly EMI, Total Interest, and Total Amount for flat interest rate and reducing interest rate. It shows both calculations side by side and also calculates how much you would save with reducing interest rate.

How to calculate reducing interest rate online using TheMunim.com?

- Visit this Reducing Interest Rate Calculator calculator online using the link added below.

- Set the values of Loan Amount, Rate of Interest (per annum), and Loan Tenure (years/months) into their respective sections.

- Then scroll down a little to get the results.

Highlights:

- Output: Monthly EMI, Total Interest, and Total Amount.

- EMI Calculation: Monthly EMI.

- Comparison: Flat Interest Rate and Reducing Interest Rate calculation comparison.

- Same/Different Rates: Uses the same interest rate for both calculations.

- Additional Feature(s): N/A.

Deal4Loans.com

Deal4Loans.com is an online loan information and comparison portal that provides valuable information. It also helps users to apply for loans, check their eligibility, calculate their EMIs, compare interest rates, etc. It has an EMI calculator that you can use to calculate reducing interest rate. You can simply add your loan amount, interest rate, and tenure into the calculator and run it to get the results. It calculates you the monthly EMI, total amount with interest, flat interest rate (per annum), flat interest rate (per month), total interest amount, and yearly interest amount. Along with that, it also plots a graph of Principal and Interest showing the change in both over the time period.

How to calculate reducing interest rate online using Deal4Loans.com?

- Go to this calculator and add your data.

- Add the Loan Amount, Interest Rate (Reducing), and Loan Tenure (in months).

- After that, click the Calculate button to get the reducing balance rate calculations.

Highlights:

- Output: Monthly EMI, Total Amount with Interest, Flat Interest Rate PA, Flat Interest Rate PM, Total Interest Amount, and Yearly Interest Amount.

- EMI Calculation: Yes, calculates monthly EMI.

- Comparison: No comparison.

- Same/Different Rates: N/A.

- Additional Feature(s): Principal + Interest visualization chart.

Frequently Asked Questions

A reducing interest rate, also known as diminishing balance interest rate, decreases over time as the outstanding loan principal reduces with each payment; this leads to lower overall interest payments compared to a flat interest rate.

Reducing interest, often used in loans, is calculated on the outstanding principal balance; each payment reduces the principal, causing subsequent interest calculations to be based on the reduced amount, gradually decreasing over time.

To calculate interest on a reducing interest rate, multiply the outstanding principal balance by the interest rate and the time period; as the principal decreases with each payment, subsequent interest calculations are based on the reduced balance.

Reducing interest rates are generally better for borrowers, as they result in lower overall interest payments over time compared to flat rates, which charge interest on the original principal throughout the loan term.

The monthly reducing rate is a method of calculating interest where the interest is charged on the outstanding loan balance at the end of each month; as the principal decreases with each payment, subsequent interest charges are based on the reduced balance.

A reducing interest rate is generally considered beneficial for borrowers, as it results in lower total interest payments over time compared to a flat interest rate, potentially saving money in the long run.

Reducing EMI is often preferred, as it ensures a gradual reduction in both principal and interest components over time, resulting in a more predictable repayment schedule; reducing tenure.

Yes, home loans are often offered with reducing interest rates, where the interest is calculated on the outstanding principal balance, leading to lower overall interest payments compared to flat interest rates.

About Us

We are the team behind some of the most popular tech blogs, like: I LoveFree Software and Windows 8 Freeware.

More About UsArchives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014