4 Best Free Online Piggyback Loan Calculator Websites

Here is a list of the best free online piggyback loan calculator websites. In a piggyback loan, instead of financing a home purchase with a single mortgage, you’re doing it with two. Both these mortgage loans are taken at the same time. One is a big loan and another is a smaller one. The second smaller loan essentially provides funds toward the down payment.

Piggyback loan splits the total amount into two separate loans. The first mortgage covers 80% of the purchase price and the second mortgage covers 10% of the purchase price. And the borrower contributes the remaining 10% as a down payment. This allows them to avoid paying private mortgage insurance (PMI). This is an example of an 80-10-10 mortgage type. Apart from that, there are 80-20, 80-15-5, 80-5-15, and 75-10-15 mortgage types.

This post covers 4 free websites where you can calculate your piggyback loan. You can pick the type of mortgage and add the total amount covering taxes and insurance as well. Along with that, you can also configure both your mortgage settings the rate of interest, and terms. This gives you the total monthly payment for the loan.

My Favorite Online Piggyback Loan Calculator

GoodCalculators.com is my favorite website on this list to calculate piggyback loan online. This calculator works with 80-10-10, 80-15-5, and 80-5-15 mortgage types. It also compares the piggyback loan and loan with PMI to help you decide which one would be a better fit.

You can check out our other lists of the best free 12 Best Free Online Payback Period Calculator Websites, Online Mortgage Overpayment Calculator Websites, and Online VAT Calculator Websites.

Comparison Table:

| Name | Total Monthly Payment | Configure Payment Tpye | PMI Comparison |

|---|---|---|---|

| GoodCalculators.com | ✓ | x | ✓ |

| AnytimeEstimate.com | ✓ | ✓ | x |

| PAFirstTimeHomeBuyer.net | ✓ | ✓ | x |

| CalcXML.com | ✓ | x | ✓ |

GoodCalculators.com

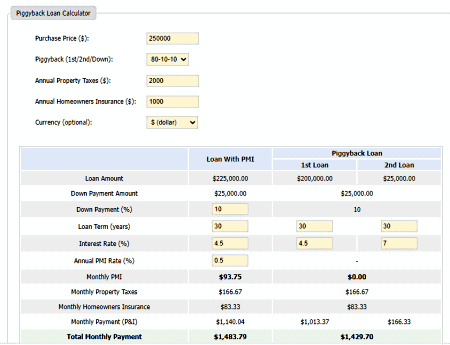

GoodCalculator.com is a popular website that provides a wide collection of online calculators. You can use its online piggyback loan calculator to determine your payments. This calculator calculates your piggyback loan payment and compares it with private mortgage insurance. The comparison can help you decide whether you should opt for a piggyback loan as opposed to taking out a loan to cover private mortgage insurance.

This calculator supports 80-10-10, 80-15-5, and 80-5-15 mortgage types. You can select the type of piggyback loan you want to perform the calculation for. You can simply add your purchase price, loan term, annual property tax, and insurance. The tool calculates the total monthly payments for a piggyback loan and compares the payment with PMI.

How to calculate a piggyback loan using this calculator?

- Go to this Piggyback Loan Calculator on GoodCalculators.com. A direct link is given below.

- Add the Purchase Price, Piggyback Loan Type, Property Tax, and Insurance into the calculator.

- This gets you a breakdown and compression of the Piggyback loan and Loan with PMI.

Highlights:

- This calculator supports 80-10-10, 80-15-5, and 80-5-15 types of piggyback loans.

- It calculates the Total Monthly Payment and compares that with PMI.

- You can re-adjust the down payment, term, interest rate, and PMI rate for quick re-calculation.

| Pros | Cons |

|---|---|

| Works with 80-10-10, 80-15-5, and 80-5-15 mortgage types | Lack the option to save calculations |

| Compares Piggyback loan and loan with PMI |

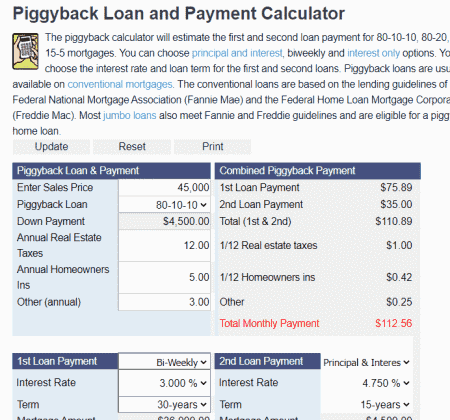

AnytimeEstimate.com

AnytimeEstimate.com has a free online Piggyback Loan and Payment Calculator. This calculator can help you calculate 1st loan payment, 2nd loan payment, and combined loan payments. It works for 80-10-10, 80-20, and 80-15-5 mortgage piggyback loan types. The calculator has four sections covering Piggyback Loan & Payment, 1st Loan Payment, 2nd Loan Payment, and 1st Loan Payment. In the Piggyback Loan & Payment section, you have to enter your entire purchase amount along with loan type, and additional costs. When you do that, the calculator automatically performs the calculation with the default interest rate.

Then in the 1st Loan Payment and 2nd Loan Payment sections, you can configure your payments. You can make any of these payments Principal & interest, Bi-weekly, and Interest Only. Then you can configure the tenure and interest for both payments and estimate the total monthly payment of the loan.

How to calculate a piggyback loan using this calculator?

- Open this calculator using the direct link added below.

- In the Piggyback Loan & Payment section, select the Piggyback loan type for the calculation.

- Then, type in your price, tax, insurance, and other expenses (if any) to get the calculation.

- You can configure your 1st Loan Payment and 2nd Loan Payment for payment type, term, and interest.

- After making the desired changes, click the Update button to re-calculate and get the total monthly payment.

Highlights:

- This calculator supports 80-10-10, 80-20, and 80-15-5 types of piggyback loans.

- It lets you pick the payment type for both piggyback payments.

- It has a print button that lets you save the calculation as a PDF file.

| Pros | Cons |

|---|---|

| It works for 80-10-10, 80-20, and 80-15-5 mortgage types | No PMI comparison |

| Option to save the calculation |

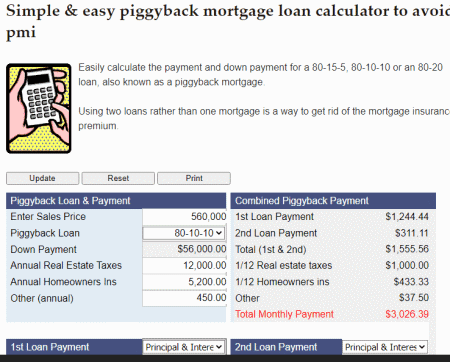

PAFirstTimeHomeBuyer.net

PAFirstTimeHomeBuyer.net is another website to calculate Piggyback loan online. This website has a Piggyback Mortgage Calculator. This calculator estimates the first and second loan payments for 80-10-10, 80-20, and 80-15-5 mortgages. You can choose principal and interest, biweekly, and interest only options for the payments. You can also set the interest rate and loan term for the first and second loans.

The procedure for the calculation is quite simple. The calculator breaks everything into different sections. For example, Piggyback Loan & Payment section takes the cost inputs whereas the 1st Loan Payment and 2nd Loan Payment sections allow you to configure your payments for the loan. With that, you can estimate your total monthly payment for the loan and print the calculation.

How to calculate a piggyback loan using this calculator?

- Load this calculator in your browser using the direct link given below.

- Enter your Sale Price, Loan Type, Down Payment, Taxes, Insurance, and other additional costs into the calculator.

- Then set the payment type for the first and second loans. Enter the loan term and add the rate of interest.

- Once done, click the Update button to get the total monthly payment of the loan.

Highlights:

- This calculator can calculate 80-10-10, 80-20, and 80-15-5 mortgage loans.

- You can change the first and second payments to principal and interest, biweekly, or interest only.

- You can print the calculation to PDF for safekeeping.

| Pros | Cons |

|---|---|

| Supports 80-10-10, 80-20, and 80-15-5 mortgage types | Only Piggyback loan calculation, no PMI comparison |

| Option to configure both mortgages | |

| Print calculations |

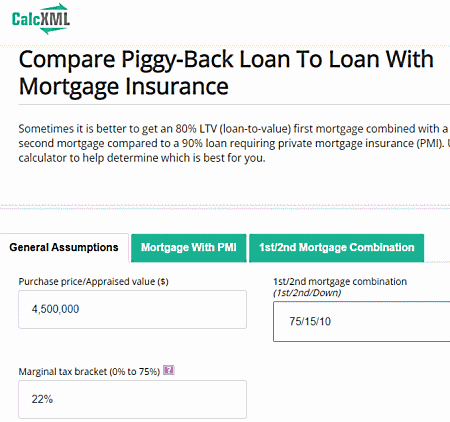

CalcXML.com

CalcXML.com offers an online calculator to compare Piggy-Back Loan To Loan With Mortgage Insurance. The calculator takes the input in three steps covering General Purchases Amounts, Mortgage with PMI, and 1st/2nd Mortgage Combination. The General Assumptions is the section where you have to add the total price along with mortgage type and tax bracket.

Then comes the Mortgage with PMI section where you can choose from Borrower Paid MI, Lender Paid MI, or Financed MI. As per the selection, you can enter your data covering the amount, interest rate, and term. Lastly, you get to the 1st/2nd Mortgage Combination section where you can set the type, interest, and term for both the loan.

In the results, the calculator gives you a summary comparing the total interest, tax savings, net cost, blended rate, and initial monthly payment. It also plots the graph of net cost comparison along with an option to share the results via email.

How to calculate a piggyback loan using this calculator?

- To perform the calculations, open this calculator by clicking on the direct link added below.

- In the General Assumptions, add your Purchase Value, Mortgage Type, and Tax bracket. Then click the Next button to proceed.

- In the Mortgage with EMI section, add your PMI method, Rate if ‘Borrower Paid MI’, Financed MI, Rate of Interest, and Term. Again, click the Next button to proceed.

- In the 1st/2nd Mortgage Amount set your mortgage type, interest, and term for both payments.

- Then click the Calculate button to get a comparison Piggy-Back Loan To Loan With Mortgage Insurance.

Highlights:

- This calculator works with 80-10-10, 80-15-5, and 75-15-10 mortgage loans.

- It gives you a comparison of Piggy-Back Loan To Loan With Mortgage Insurance with a graph.

- You have the option to send the calculations via email.

| Pros | Cons |

|---|---|

| Supports 80-10-10, 75-15-5 mortgage types | No direct option to include additional costs |

| Multiple methods of PMI Options | |

| Compares Piggyback loan to loan with mortgage insurance | |

| Option to share results via email |

Frequently Asked Questions

The 80-10-10 ratio piggyback loan is a type of mortgage financing arrangement used to purchase a home. It involves splitting the total loan amount into three parts: 80% of the purchase price is covered by a first mortgage. 10% of the purchase price is covered by a second mortgage (piggyback loan). And the remaining 10% is paid as a down payment by the borrower.

A piggyback loan involves splitting the total loan amount into two separate loans: the first mortgage covering 80% of the home's purchase price, and the second mortgage (piggyback loan) covering 10% of the purchase price. The borrower contributes the remaining 10% as a down payment, allowing them to avoid paying private mortgage insurance (PMI).

The advantage of a piggyback loan is that it enables borrowers to avoid paying private mortgage insurance (PMI) when they cannot make a 20% down payment.

An 80/20 loan splits the amount into two. The first part is a mortgage that covers 80% of the home purchase price. And the second part is either a home equity loan or a home equity line of credit that covers the remaining 20%.

To calculate the 80% loan-to-value (LTV) ratio, divide the loan amount by 80% of the appraised value of the property, and then multiply the result by 100 to get the percentage. The formula is: LTV = (Loan Amount / (0.8 * Appraised Value)) * 100.

Yes, an indivisual can take more than one personal loan.

A 100% loan means that the borrower is financing the entire cost of the purchase without making any down payment. In this case, the loan amount equals the full purchase price, covering the entire cost of the property or item being financed.

A hybrid loan is a type of mortgage that combines features of both fixed-rate and adjustable-rate mortgages (ARMs). It typically starts with a fixed interest rate for a certain period, usually 3, 5, 7, or 10 years, and then switches to an adjustable rate for the remaining loan term, resulting in potential changes to the monthly payment after the initial fixed-rate period ends.

About Us

We are the team behind some of the most popular tech blogs, like: I LoveFree Software and Windows 8 Freeware.

More About UsArchives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014