9 Best Free Online Crypto Tax Calculator Websites

Here is a list of best free crypto tax calculator websites. Crypto tax is a tax imposed by governments on transactions of cryptocurrencies like Bitcoin, Ethereum, Tether, Litecoin, etc. Like other taxes, users can also calculate the crypto tax manually based on the taxation rate and profit amount from crypto transactions. The manual process of crypto calculation takes time and effort. To simplify this process, most users take help from these online crypto tax calculation websites.

These websites simplify the process of calculating the crypto tax on one or more crypto transactions. On most websites, users just need to specify the crypto sale and purchase prices to perform the calculation. However, some websites also require additional parameters (taxable income, holding period, financial year, etc.) to calculate the crypto tax amount. A few websites can also calculate additional parameters like profit amount, loss amount, profit after tax, GST amount, etc. To help novice users, I have also included the necessary calculation steps in the description of each website.

These websites also come with additional tools like Crypto Price Tracker, Crypto Profit Calculator, Income Tax Calculator, etc. Go through the list to learn more about these websites.

My Favorite Online Crypto Tax Calculator Website:

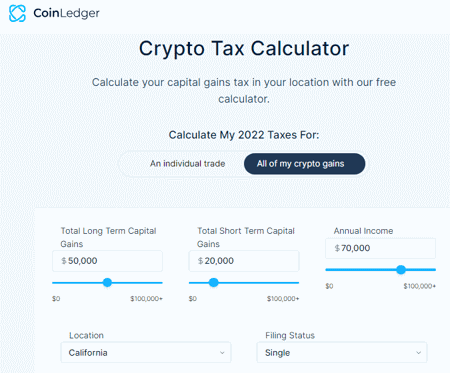

coinledger.io is my favorite website as it lets users calculate crypto taxes on both individual and all crypto assets. Plus, it can also calculate the profit and loss amounts on crypto transactions.

You can also check out lists of best free Cryptocurrency Screener, Online Capital Gains Tax Calculator, and Online Bitcoin Mining Calculator websites.

Comparison Table:

| Features/Website Names | Can calculate taxes on individual and all crypto assets | Can calculate the profit and loss on crypto transactions | Answers common queries related to crypto tax calculation |

|---|---|---|---|

| coinledger.io | ✓ | ✓ | ✓ |

| murdex.com | ✓ | ✓ | ✓ |

| cleartax.in | x | ✓ | ✓ |

| forbes.com | x | ✓ | ✓ |

| koinx.com | x | ✓ | ✓ |

| tax2win.in | x | ✓ | ✓ |

| binocs.co | x | ✓ | ✓ |

| eztax.in | x | ✓ | x |

| taxscouts.com | x | ✓ | ✓ |

coinledger.io

coinledger.io is a free online crypto tax calculator website. Through this website, users can calculate the crypto tax amount on individual crypto trades and on all combined crypto gains. To perform this calculation, it requires multiple input values from users such as Investment Amount, Buy Price, Sell Price, Investment Fees, Exit Fee, Annual Income, Length of Ownership, Location, and Filing Status. After performing the calculation, it shows the total capital gain tax, federal tax, and state tax values. It also explains crypto tax and shows the formula to calculate the crypto tax. Now, follow the below steps.

How to calculate crypto tax online using coinledger.io:

- Go to this website using the given link.

- After that, enter all the required values.

- Next, let this calculator perform the calculation.

- Finally, view the total crypto tax, state tax, and federal tax amounts.

Additional Feature:

- This website also comes with a handy portfolio tracker tool.

Final Thoughts:

It is one of the best free online crypto tax calculator websites that can calculate crypto taxes on individual crypto trades and combined crypto trades.

| Pros | Cons |

|---|---|

| Can calculate taxes on individual and all crypto trades |

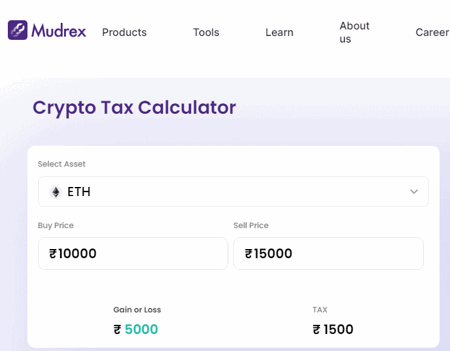

murdex.com

murdex.com is another free online crypto tax calculator website. Using this website, users can calculate the crypto tax on the transfer and selling of different cryptocurrencies such as Bitcoin, Ethereum, Dai, and more. It also lets users calculate the crypto taxes on individual cryptocurrencies and multiple crypto assets. The process to calculate the crypto tax is also quite simple on this website as users just need to add one or more crypto assets and specify their buy and sell prices. Now, follow the below steps.

How to calculate crypto tax online using murdex.com:

- Start this website using the provided link.

- After that, add one or more crypto assets and specify the name of each cryptocurrency.

- Now, enter the buy and sell prices of all crypto assets.

- Next, view the crypto tax on individual assets and combined crypto taxes on all crypto assets. It also shows the profit and loss values.

Additional Features:

- This website also comes with additional tools such as Crypto Returns Calculator, Crypto Fear Index, Crypto Greed Index, Crypto Price Tracker, and more.

Final Thoughts:

It is another good online crypto tax calculator website through which users can calculate crypto taxes on individual crypto assets and crypto taxes on all crypto assets.

| Pros | Cons |

|---|---|

| Can calculate taxes on individual and all crypto assets |

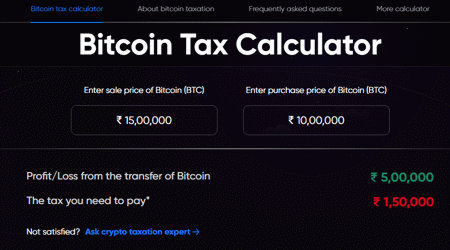

cleartax.in

cleartax.in is a free online crypto tax calculator website. Through this website, users can calculate the amount of taxes they need to give to the Indian government on Crypto earnings. To do that, users need to specify the sale and purchase prices of crypto assets. It also shows the percentage of tax users need to pay and also shows the steps to use this crypto tax calculator. This website also explains the common queries related to Crypto tax calculation. Now, follow the below steps.

How to calculate crypto tax online using cleartax.in:

- Go to this website and access the Crypto Assets Tax calculator.

- Now, enter sales and purchase prices of crypto assets.

- Next, view the calculated tax that you need to pay. Besides this, it also shows the profit or loss made by you on the transfer of Bitcoins.

- Finally, copy the calculated values.

Additional Features:

- This website also offers additional online tools such as the Ethereum tax calculator, NFT tax calculator, SIP calculator, PPF Calculator, FD Calculator, and more.

Final Thoughts:

It is another good online crypto tax calculator website through which users can calculate the total tax they need to pay on the transfer of crypto assets.

| Pros | Cons |

|---|---|

| Shows the percentage of tax users need to pay on crypto assets transfer | |

| Provides the steps to use this calculator |

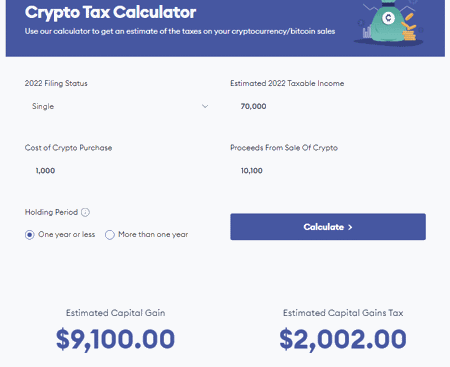

forbes.com

forbes.com is another free online crypto tax calculator website. This website offers a simple Crypto tax calculator 2022-2023. This calculator helps users determine the amount of crypto tax they need to pay on the spending, selling, and exchanging of crypto assets. To do that, users need to specify Filing Status (single, head of house, etc.), estimated taxable income amount, cost of crypto purchase, proceeds from sales of crypto, and holding period (one year or less or more than a year). Using the provided values, it performs the calculation and shows both the crypto tax amount and the estimated capital gain amount. This website also answers multiple questions related to crypto taxes. Now, check out the below steps.

How to calculate cryto tax online using forbes.com:

- Visit this website and access the crypto tax calculator.

- After that, enter all the required input values like estimated taxable income, cost of crypto purchase, proceeds from sales of crypto, etc.

- Next, click on the calculate button to view the crypto tax amount and the amount of capital gains.

Additional Features:

- This website also offers handy tax calculators such as Paycheck, Capital Gains Tax, Income Tax, and more.

Final Thoughts:

It is another simple online crypto tax calculator website that helps users estimate the taxes users need to pay on crypto purchases and transfers.

| Pros | Cons |

|---|---|

| Can also calculate the capital gain amount | |

| Answers common queries related to crypto tax |

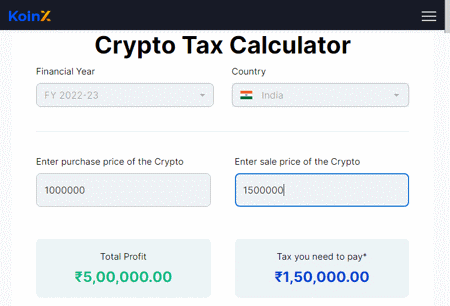

koinx.com

koinx.com is another free online crypto tax calculator website. This website offers a simple crypto calculator for the financial year 2022-2023. This calculator is mainly used to calculate the amount of taxes users need to pay on their crypto assets sales in India. Plus, it can also be used to calculate the total profit users can make from selling a set of crypto assets. It also explains the crypto tax calculator and shows the process of using this calculator. Now, follow the below steps.

How to calculate crypto tax online using koinx.com:

- Visit this website and access its Crypto Tax Calculator.

- After that, enter the purchase and sale prices of crypto assets.

- Next, view the calculated crypto tax and profit amount that users can copy.

Additional Features:

- This website also has three additional crypto tools namely Crypto price tracker, Crypto profit calculator, and Crypto calculator.

Final Thoughts:

It is another simple online crypto tax calculator website that can also be used to calculate the profit or loss on crypto sales.

| Pros | Cons |

|---|---|

| Can also calculate profit or loss on crypto sales |

tax2win.in

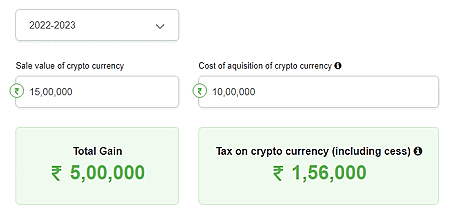

tax2win.in is another free online crypto tax calculator website. Through this website, users can calculate the taxes users need to pay on sales and transfers of various cryptocurrency assets like Bitcoin, Ethereum, etc. To do that, it requires a financial year, cost of crypto acquisition, and sale value of crypto assets. Unlike most other similar websites, it calculates the crypto tax amount including cess. It also calculates and shows the total gain or loss amount.

This website also explains the structure of crypto tax in India. Plus, multiple examples highlighting the process of crypto tax calculations are also provided. This website also covers common questions related to crypto tax. Now, follow the below steps.

How to calculate crypto tax online using tax2win.in:

- Start this website using the given link.

- After that, specify the financial year.

- Now, submit the sale and purchase prices of crypto assets.

- According to the provided values, it calculates and shows the crypto tax and total gain/ loss amounts.

Additional Features:

- This website also offers a good set of financial calculators such as Income Tax, HRA, Gratuity, Rent Receipt, TDS, and more.

Final Thoughts:

It is another capable online crypto tax calculator website through which users can calculate the crypt tax and crypt gain or loss amount.

| Pros | Cons |

|---|---|

| Can also calculate the crypto gain or loss amount | |

| Offers examples of crypto tax calculation | |

| Shows steps to use this calculator |

binocs.co

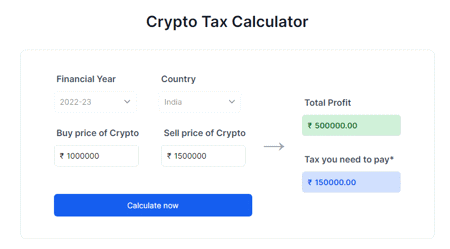

binocs.co is another free online crypto tax calculator website. This website comes with one of the simplest online crypto tax calculators that only uses buy and sell prices of crypto assets to calculate profit or loss amount and total crypto tax amount. It also explains the structure of crypto tax in India. The process to calculate crypto tax is also provided by it. Now, follow the below steps.

How to calculate crypto tax online using binocs.co:

- Launch this website and access the crypto tax calculator.

- After that, enter the buy and sell prices of crypto assets.

- Next, click on the Calculate Now button to start the calculation process.

- Finally, view the calculated crypto tax and profit or loss amount.

Additional Features:

- On this website, users can also find handy tools like Portfolio Tracker, Crypto Accounting, Crypto Profit Calculation, and more.

Final Thoughts:

This website offers a standard and easy-to-use online crypto tax calculator that anyone can use with ease.

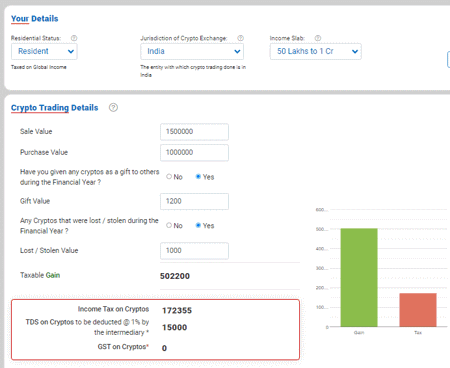

eztax.in

eztax.in is yet another free online crypto tax calculator website. Using this website, users can calculate the crypto tax, TDS, and GST on crypto trading. Performing these calculations requires multiple inputs from users such as Residential Status, Income Slab, Sale Value, Purchase Value, Gift Value, Stolen Value, etc. According to the entered values, it automatically calculates and shows the crypto tax, TDS, and GST tax amounts. Besides this, it also generates a Gains vs Tax graph. It also shows the steps that it takes to calculate the crypto tax amount. Now, follow the below steps.

How to calculate crypto tax amount online using eztax.in:

- Open the interface of this website and go to its Crypto tax calculator section.

- Now, enter the sale value, purchase value, gift value, and other required inputs.

- Next, view the calculated crypto tax amount along with TDS and GST values.

Additional Features:

- On this website, users also get multiple Tax Expert Services like GST Registration, GST Tax Filing, Tax Savings, Investment Advisories, and more.

Final Thoughts:

It is another simple and effective online crypto tax calculator that can also be used to calculate the TDS and GST on crypto profit.

| Pros | Cons |

|---|---|

| It can also calculate GST and TDS on crypto profits | |

| Generates Gain vs Tax bar graph |

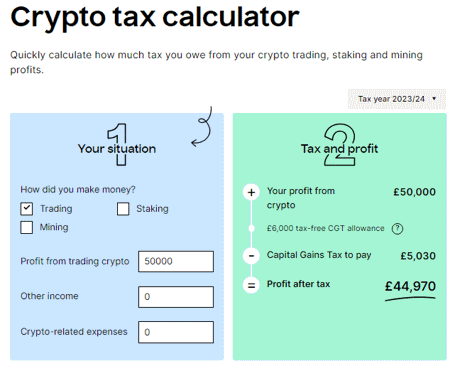

taxscouts.com

taxscouts.com is the last free online crypto tax calculator website. Through this website, users can calculate the crypto tax and profit on crypto trading, crypto staking, and crypto mining. Plus, it shows the process that this website uses to calculate the crypto tax amount. It also answers multiple queries related to crypto tax calculation. Now, follow the below steps.

How to calculate crypto tax online using taxscouts.com:

- Go to this website and access the Crypto tax calculator.

- Now, specify the method to make money (trading, staking, or mining).

- Next, specify tax year, profit amount, other income, and crypto expanses.

- Finally, view the calculated crypto tax, profit from crypto, and profit after tax amount.

Additional Features:

- This website also online services like tax returns, tax accountants, tax advice, bookkeeping, and more.

Final Thoughts:

It is another good online crypto tax calculator website that offers all the tools to calculate crypto tax and profit after-tax amount.

| Pros | Cons |

|---|---|

| Can also calculate profit after tax and profit from crypto values |

Frequently Asked Questions

To quickly and accurately calculate the taxes on your crypto transactions, you can try the above-mentioned crypto tax calculator websites. These websites ask for basic inputs like crypto sale price, crypto purchase price, holding period, etc. Based on the provided values, they calculate and show the exact taxes you need to pay on your crypto profits.

The taxable amount of profit from cryptocurrency transactions can vary depending on your country's tax laws and regulations. In most jurisdictions, cryptocurrency gains are subject to taxation when you realize a profit.

TDS (Tax Deducted at Source) is typically a mechanism used in various countries to collect taxes at the source of income. Whether TDS on cryptocurrency is refundable or not depends on the specific tax laws and regulations in your country. The refundability of TDS can vary widely from one jurisdiction to another. In some cases, TDS on cryptocurrency transactions may be refundable under certain conditions.

Losses on cryptocurrency transactions can have tax implications, but they generally work differently than gains. Whether a loss on cryptocurrency is taxable or not depends on the tax laws in your specific jurisdiction.

Singapore is the only country that doesn't tax individuals and businesses on all their crypto transactions.

In the United States, receiving cryptocurrency as a gift can have tax implications, both for the person giving the gift (the donor) and the person receiving the gift (the recipient)

Naveen Kushwaha

Passionate about tech and science, always look for new tech solutions that can help me and others.

About Us

We are the team behind some of the most popular tech blogs, like: I LoveFree Software and Windows 8 Freeware.

More About UsArchives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014