12 Best Free Online Earned Income Credit Calculator Websites

Here is a list of best free online earned income credit calculator websites. Earned Income Tax Credit or EITC is a type of tax credit given to low and moderate-income individuals. Although, it is not easy to find out the EITC amount of an individual. If you want to estimate the EITC amount that you can get, then check out these earned income credit calculator websites.

Some of these websites can check whether an individual is eligible for EITC or not. To estimate the EITC amount, these websites ask various questions from users like marital status, filing status, earned income, number of children, your age, etc. After analyzing the input values, these websites calculate and show the estimated EITC value. On some of these websites, users also get all definitions of input EITC parameters that these websites ask users to fill in. To help out new users. I also included the steps of EITC calculation in the description of each website.

These websites also offer additional online tools such as Pay Rise Calculator, IRS Interest Calculator, Tax Filing Calculator, and more. Go through the list to know more about these websites.

My Favorite Online Earned Income Credit Calculator Website:

goodcalculators.com is my favorite website as it can calculate EITC and also check users’ eligibility to get EITC.

You can also check out lists of best free Online Actual Cash Value Calculator, Online 401k Calculator, and Online Annuity Calculator websites.

Table of Contents:

| Features/Website Names | Estimate EITC Amount | Lets Users Check EITC Eligibility | Offer additional Tax and Financial Tools |

|---|---|---|---|

| goodcalculators.com | ✓ | ✓ | ✓ |

| taxoutreach.org | ✓ | ✓ | ✓ |

| bankrate.com | ✓ | x | ✓ |

| ftb.ca.gov | ✓ | x | x |

| dinkytown.net | ✓ | x | ✓ |

| efile.com | ✓ | x | ✓ |

| blog.taxact.com | ✓ | x | ✓ |

| communitychange.org | ✓ | x | x |

| gov.uk | ✓ | x | ✓ |

| myhousetax.com | ✓ | x | ✓ |

| expattaxonline.com | ✓ | x | x |

| surepayroll.com | ✓ | x | x |

goodcalculators.com

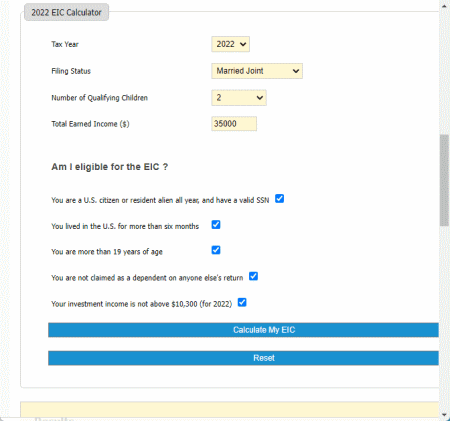

goodcalculators.com is a free online earned income credit calculator website. This website helps users calculate their earned income credit of users if they are eligible for it. To do that, it uses the four primary values Tax Year, Filing Status (Married Joint, Married Separate, Head of House or Qualified Widower), Number of Qualifying Children, and Total Earned Income values. Besides this, it also checks for the eligibility of users by asking questions like U.S. Citizen or not, yar are more than 19 years old or not, etc. After filling out all the details, users can start the calculation process to find out the EIC amount in US dollars. Now, follow the below steps.

How to calculate earned income credit online using goodcalculators.com:

- Visit this website using the given link.

- After that, enter the Tax year, Filing Status, etc., details.

- Now, answer the EIC eligibility questions.

- Lastly, click on the Calculate my EIC button to view the final earned income credit value.

Additional Features:

- This website also offers additional online calculators like Pay Rise Calculator, IRS Interest Calculator, Wage Conversion Calculator, Dividend Tax Calculator, and more.

Final Thoughts:

It is a good online earned income credit calculator website that can give users an estimate of their EIC and also check their EIC eligibility.

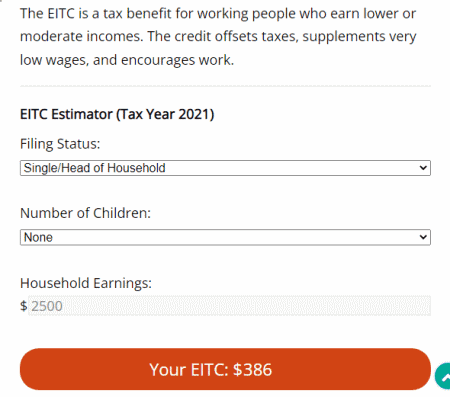

taxoutreach.org

taxoutreach.org is another free online earned income credit calculator website. Using this website, users can calculate their earned income credit value. Besides this, it also helps users to find out their eligibility to get earned income credit. Besides this, it also guides users to claim their EITC. Now, to perform the calculation, it requires three input parameters namely Filing Status (Single/ Head of the house or Married), Number of Children, and Household Earnings. Now, follow the below steps.

How to calculate earned income credit online using taxoutreach.org:

- Visit this website using this given link.

- After that, enter the filing status, number of children, and household earning values.

- Lastly, view the estimated EITC value in dollars under the Your EITC field.

Additional Features:

- This website also offers calculators associated with Stimulus Payments, Tax Credits, Tax Filing, and Rideshare Taxes.

Final Thoughts:

It is another good online earned income credit calculator website that can quickly calculate the EITC amount and helps users to check their EITC eligibility.

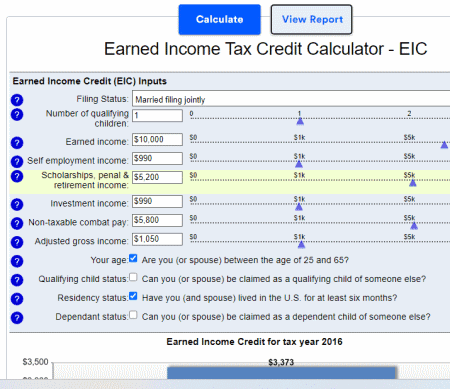

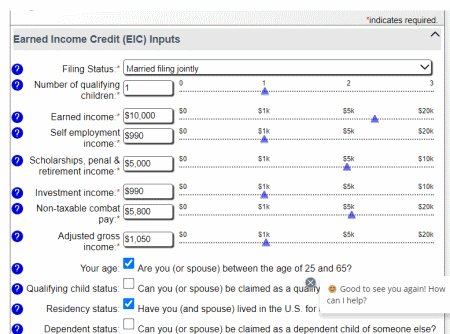

bankrate.com

bankrate.com is another free earned income tax credit calculator website. It is another good website to calculate the earned income tax credit. To perform the calculation, it focuses on EIC inputs like Filing Status, Number of qualifying children, Earned Income, Self Employment Income, Investment Income, Adjusted Gross Income, etc. It also asks some eligibility questions like age, residency status, dependant status, etc. Besides this, it also provides definitions related to EIC parameters like Filing Status, Number of Qualifying Children, Earned Income, etc. Now, follow the below steps.

How to calculate earned income credit online using bankrate.com:

- Visit this website and open up the earned income tax credit calculator.

- After that, enter the EITC values like earned income, filing status, etc.

- Next, tackle the eligibility questions.

- In the end, view the final earned income credit tax value in dollars.

Additional Features:

- This website also offers online calculators to solve problems related to various fields like Mortgages, Banking, Loans Investment, Hom Equity, etc.

Final Thoughts:

It is another good online earned income tax credit calculator website that offers all the essential tools to accurately estimate the EITC value.

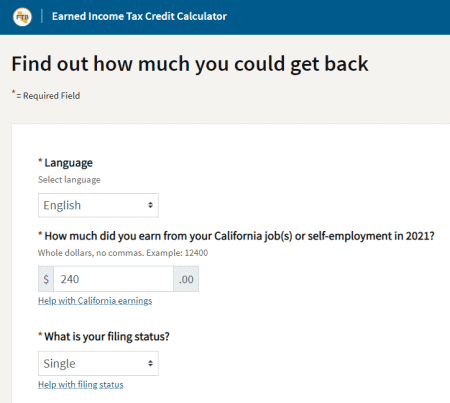

ftb.ca.gov

ftb.ca.gov is a free online earned income tax credit calculator website. Through this website, users can estimate their earned income tax credit value. To do that, it requires multiple values from users such as total earnings, filing status, number of qualifying children, investment amount, etc. Besides this, users need to select some answers that apply to them like having a social security number, having a taxpayer identification number, being at least 18 years old, etc. After answering all the questions, users can start the calculation process.

How to calculate earned income tax credit online using ftb.ca.gov:

- Visit this website and open up the EITC calculator.

- After that, enter the required values like income, filing status, investment amount, etc.

- Next, select answers that apply to you.

- In the end, click on the Estimate my EITC button to view the calculated California EITC, Young Child Tax Credit, and Federal EITC.

Additional Features:

- This website also helps users check their refund status, CalFile, Court-Ordered Debt, etc.

Final Thoughts:

It is another capable online earned income tax credit calculator website that can calculate both Federal and California EITC values.

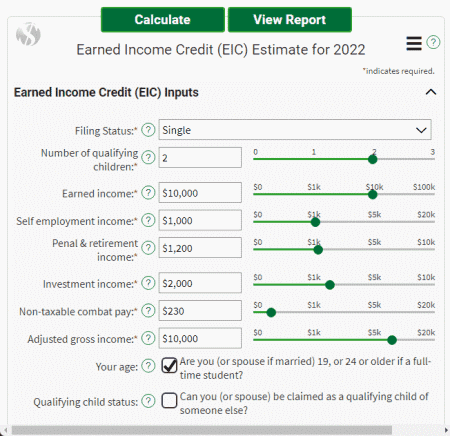

dinkytown.net

dinkytown.net is another free online earned income tax credit calculator website. This website considers various parameters taken from users before estimating the earned income tax credit value. Some of the values it asks users to fill are Filing Status, Number of Qualifying Children, Earned Income, Self Employment Income, Investment Income, Adjusted Groll Income, etc. Plus, it also explains all the input parameters in detail. Now, follow the below steps.

How to calculate earned income tax credit online using dinkytown.net:

- Visit this website using the given link.

- After that, enter the earned income credit input values. like filing status, earned income, etc.

- Next, specify the residency status, dependant status, age, and qualifying child status.

- Lastly, view the calculated earned income tax credit value in the output field.

Additional Features:

- Calculators: This section carries multiple calculators like Investment, Mortgage, Loans, Credit Card & Debt, and more.

Final Thoughts:

It is another good online earned income tax credit calculator website that anyone can use with ease.

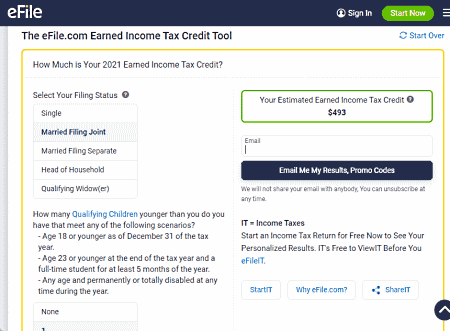

efile.com

efile.com is another free online earned income tax credit calculator website. It is another good EIT calculator website that asks multiple questions from users to take input and check their eligibility. Some of the questions that it asks are Filing Status, Qualifying Children, and Adjusted Gross Income. It also explains what is earned income tax credit calculator is and how to claim the earned income tax. Now, follow the below steps.

How to calculate earned income tax credit online using efile.com:

- Go to this website and access the earned income tax credit amount section.

- Now, answer all the asked questions.

- Next, click on the Calculate My Credit button to start the calculation process.

Additional Features:

- This website also offers additional online tools like W-4 Form Taxometer, Third STIMUlator, State Only Returns, Tax Amendments, etc.

Final Thoughts:

It is another good online earned income tax credit calculator website that anyone can use without much hassle.

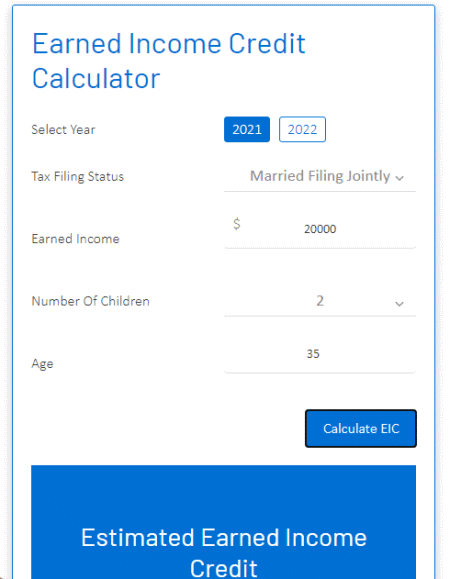

blog.taxact.com

blog.taxact.com is another free online earned income tax credit calculator website. This website offers a simple calculator that also shows the steps of earned income tax credit calculation. Plus, it requires only four input parameters from the users namely Tax Filing Status, Earned Income, Number of Children, and Age. Although, it can calculate EITC for years 2021 and 2022. It also answers multiple frequently asked questions related to EITC. Now, follow the below steps.

How to calculate earned income tax credit online using blog.taxact.com:

- Go to this website using the provided link.

- After that, choose the year 2021 or 2022.

- Now, enter the tax filing status, earned income, number of children, and age

- Finally, click on the Calculate EIC button to view the estimated earned income credit.

Additional Features:

- This website also offers additional tools associated with Tax Returns and Income Tax.

Final Thoughts:

It is another capable online earned income tax credit calculator that offers all the essential tools to calculate EITC.

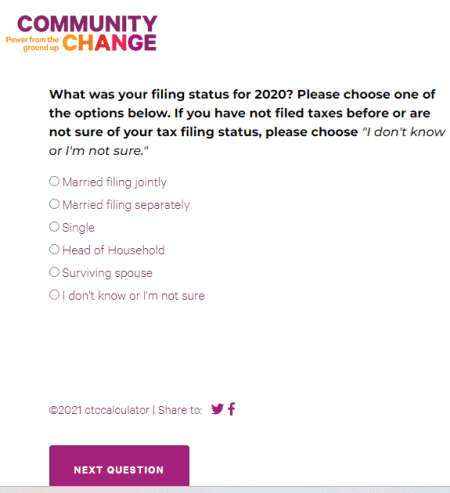

communitychange.org

communitychange.org is another free online income tax credit calculator website. This website comes with a Child Tax Credit and Earned Income Tax Credit Benefit calculator. This calculator asks a series of questions to estimate the EITC benefit amount. Questions that it asks from the users are Filing Status, number of people for which you are financially responsible, gross income, etc. Now, follow the below steps.

How to calculate earned income tax credit online using communitychange.org:

- Visit this website using the given link.

- After that, answer all the questions asked on this website.

- Once all the questions get finished, users will get the estimated income tax credit unit.

Final Thoughts:

It is a simple and effective online earned income tax credit calculator website that anyone can use to estimate the EITC value.

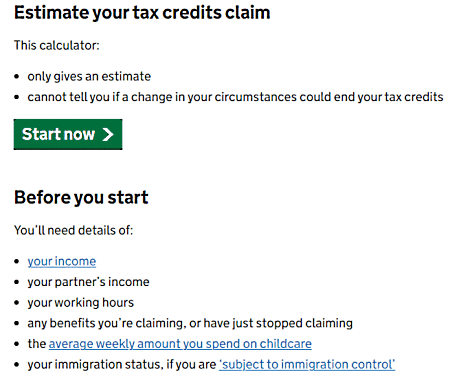

gov.uk

gov.uk is a free online earned income tax credit calculator website. On this website, users get a dedicated earned income tax credit calculator website that anyone can use. Like other similar websites, it also asks a series of questions to calculate the EITC value. After analyzing all the answers submitted by the users, this website performs the calculation and shows the output earned income tax credit value. Now, follow the below steps.

How to calculate earned income tax credit value online using gov.uk:

- Go to this website and click on the Start button.

- Now, answer all the asked questions.

- In the end, click on the Calculate button to view the final value.

Additional Features:

- This website also offers additional online tools related to Income Tax, VAT, Child Benefits, Paying HMRC, etc.

Final Thoughts:

It is another good online earned income tax credit calculator through which users can easily find out their EITC value.

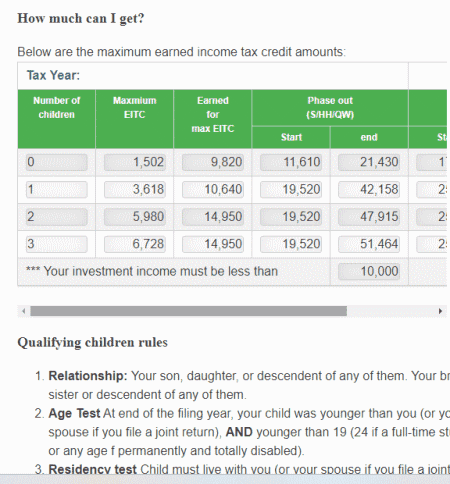

mytaxhouse.com

mytaxhouse.com is yet another free online earned income tax credit calculator website. To perform this calculation, users need to specify the year of EITC, number of children, Maximum EITC, Earned for max EITC, Phase Out, etc. Besides this, it also answers various questions related to EITC like what is EITC, Do you qualify for EITC, Qualifying Children Rules, etc. Now, follow the below steps.

How to calculate earned income tax credit value online using myhousetax.com:

- Go to this website and access the EITC calculator.

- Next, specify the EITC year.

- After that, enter the input values like number of children, maximum EITC, etc.

- Lastly, view the estimated earned income tax credit value in the final row.

Additional Features:

- Tax Tools: This website offers multiple tax tools like IRA Calculator, EIC Calculator, Federal Income Tax Calculator, etc.

Final Thoughts:

It is another simple-to-use online EITC calculator that helps users estimate the final EITC value.

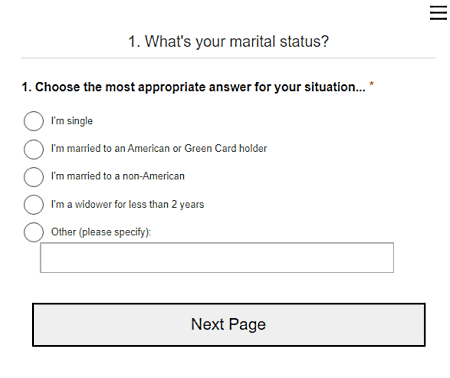

expattaxonline.com

expattaxonline.com is another free online earned income tax credit calculator website. Through this website, users can check their eligibility for EITC and also estimate their earned income tax credit amount. Like other similar websites, it also asks a series of questions to estimate the EITC amount. According to the submitted answers, it calculates and shows the EITC amount. Now, follow the below steps.

How to calculate earned income tax credit value online using expattaxonline.com:

- Visit this website using the provided link.

- After that, answer each question one by one such as What your marital status, number of dependent children, gross income, etc.

- In the end, you can view the estimated EITC amount.

Additional Features:

- This website also offers online services to generate tax returns for American citizens.

Final Thoughts:

It is another capable yet simple earned income tax credit calculator website.

surepayroll.com

surepayroll.com is another free online earned income tax credit calculator website. This website comes with earned income credit calculator that helps users estimate the earned income credit for a specific year. To do that, it requires multiple EIC inputs from users like Filing Status, Number of qualifying children, Earned Income, Investment Income, Adjusted Gross Income, Age, Residency Status, etc. This website also shows the definitions of all the input EIC parameters like Earned Income, Self-Employment Income, Filing Status, etc. Now, follow the below steps.

How to calculate earned income tax credit value online using surepayroll.com:

- Launch this website and go to the EIC calculator section.

- Now, input all the asked earned income credit input values.

- Next, click on the Calculate button to view the final EIC value.

Additional Features:

- This website also offers additional online services like payroll services for small businesses, HR Services, benefits Services, and more.

Final Thoughts:

It is another good online earned income tax credit calculator that anyone can use without much hassle.

Naveen Kushwaha

Passionate about tech and science, always look for new tech solutions that can help me and others.

About Us

We are the team behind some of the most popular tech blogs, like: I LoveFree Software and Windows 8 Freeware.

More About UsArchives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014