5 Best Free Online Solvency Ratio Calculator Websites

Here is a list of best free online solvency ratio calculator websites. Solvency Ratio is a financial metric that helps users estimate how well their company can cover its debts with its assets. A high solvency ratio indicates a company is financially stable and has a low risk of defaulting due to its debts. On the other hand, a low solvency ratio suggests a company may have difficulty meeting all its financial obligations due to excessive debts. If you also want to calculate the solvency ratio of a company, then check out these online solvency ratio calculator websites.

Users can use these websites to calculate the solvency ratio using either net income, depreciation, and liabilities or shareholders’ equity and total assets. Some websites use the first set of input parameters while others use the second set to determine the actual solvency ratio. Some websites also explain the solvency ratio and provide the formula to calculate the solvency ratio. A few websites even offer solvency ratio calculation steps. To help new users, I have included the necessary calculation steps in the description of each website.

These websites offer related financial calculators like Break Even, FCNR, CAPM, Sales, Margin, Profit, and more. Go through the list to learn more about these websites.

My Favorite Online Solvency Ratio Calculator Website:

calculator.academy is my favorite website as it defines solvency ratio and shows the steps to calculate it. Plus, it also highlights the solvency ratio calculation formula for users.

You can also check out lists of best free Online Profitability Index Calculator, Online Capital Gains Yield Calculator, and Online Home Loan Affordability Calculator websites.

Comparison Table:

| Features/Website Names | Shows solvency ratio calculation formula | Defines Solvency Ratio | Shows steps of calculation |

|---|---|---|---|

| calculator.academy | ✓ | ✓ | ✓ |

| calculatorschool.com | x | x | x |

| easycalculation.com | ✓ | x | x |

| calculatoratoz.com | ✓ | x | ✓ |

| mymathtables.com | ✓ | x | ✓ |

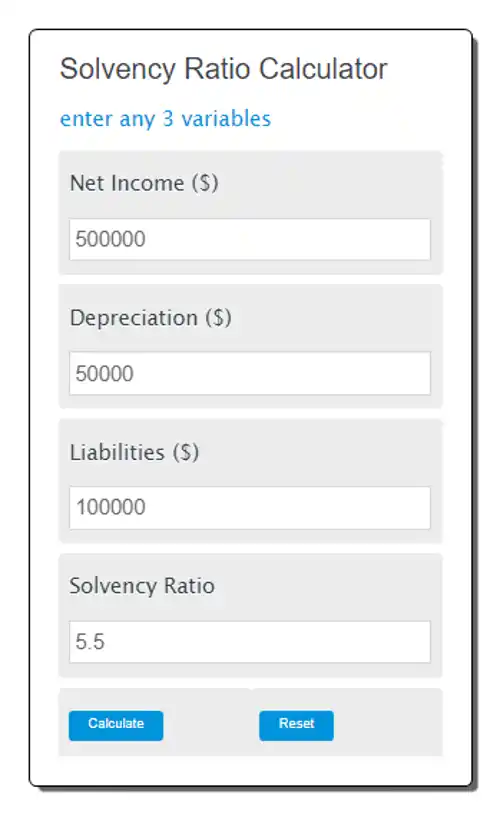

calculator.academy

calculator.academy is a free online solvency ratio calculator website. This website allows users to calculate the solvency ratio using the net income, depreciation, and liabilities values of a company. It also defines the solvency ratio and shows the solvency ratio calculation formula. To further help out users, it shows steps to calculate the solvency ratio through the website. Now follow the below steps.

How to calculate solvency ratio online using calculator.academy:

- Visit this website and access the solvency ratio calculator.

- After that, enter net income, depreciation, and liabilities values.

- Now, click on the Calculate button to start the calculation process.

- Finally, view the calculated solvency ratio value.

Additional Features:

- This website offers multiple finance calculators like Sales, Margin, Profit, Mortgage, Return on “X”, and more.

Final Thoughts:

It is one of the best free online solvency ratio calculator websites that calculates the solvency ratio and shows the calculation steps.

| Pros | Cons |

|---|---|

| Shows calculation steps | |

| Shows calculation formula | |

| Define solvency ratio |

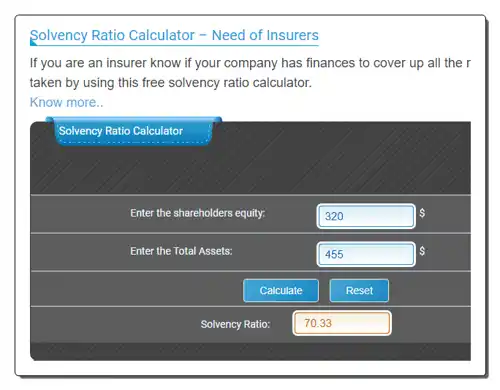

calculatorschool.com

calculatorschool.com is another free online solvency ratio calculator website. This website offers a straightforward solvency ratio calculator website that uses shareholders’ equity and total assets in US dollars to calculate the solvency ratio. However, it doesn’t define the solvency ratio, nor does it provide any data associated with the solvency calculator. Now, follow the below steps.

How to calculate solvency ratio online using calculatorschool.com:

- Visit this website and access the Solvency Ratio Calculator.

- After that, enter the shareholder’s equity and total assets values in US dollars.

- Next, click on the Calculate button to start the calculation process.

- Finally, view and copy the solvency ratio value.

Additional Features:

- This website offers multiple online tools such as Break Even Calculator, FCNR Calculator, CAPM Calculator, Days in Inventory, and more.

Final Thoughts:

It is another good online solvency ratio calculator website that anyone can use to find out a company’s solvency ratio.

| Pros | Cons |

|---|---|

| Only uses shareholders’ equity and total assets values to calculate solvency ratio | Lacks information related to the solvency ratio |

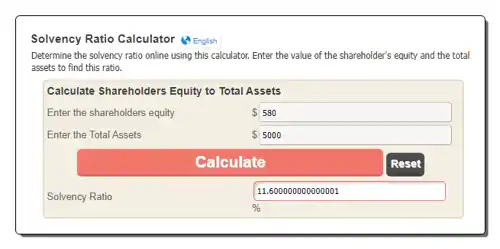

easycalculation.com

easycalculation.com is another free online solvency ratio calculator website. This website offers multiple online calculators including a solvency ratio calculator. This calculator allows you to calculate the solvency ratio percentag using shareholders’ equity and total asset values. It also shows the solvency ratio calculation formula that it uses to perform the calculation. Now, follow the below steps.

How to calculate solvency ratio online using easyclaculation.com:

- Go to this website using the given link.

- After that, enter shareholders equity and total assets values in US dollars.

- Next, hit the Calculate button to view the final solvency ratio percentage.

Additional Features;

- This website has multiple Stock, Inventory, Employee Benefits, Savings, and Investments calculators.

Final Thoughts:

It is another capable online solvency ratio calculator website that anyone can use to find out the solvency ratio of a company in no time.

| Pros | Cons |

|---|---|

| Only uses shareholders’ equity and total assets values to calculate solvency ratio | |

| Shows calculation formula |

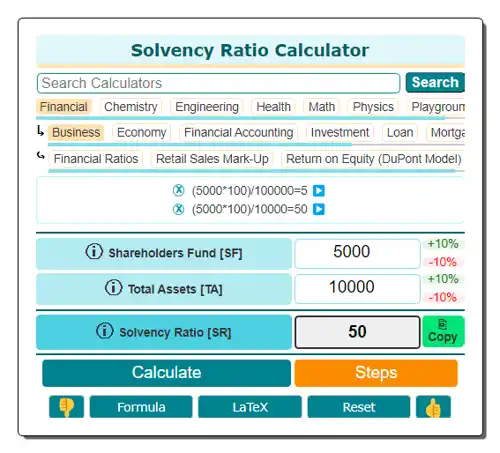

calculatoratoz.com

calculatoratoz.com is another free online solvency ratio calculator website. This website offers a simple solvency ratio calculator that helps users find out the solvency ratio of a company. To do that, it needs Shareholders Fund and Total Assets values. It even provides the calculation formula and steps of calculation. It also explains the parameters involved in the calculation. However, it doesn’t define the solvency ratio. Now, follow the below steps.

How to calculate solvency ratio online using calculatoratoz.com:

- Open the interface of this website using the given link.

- After that, enter the Shareholder’s Fund and Total Assets values of a company.

- Next, click on the Calculate button to view the Solvency Ratio that users can copy from its interface.

Additional Features:

- This website contains multiple business calculators like target inventory, acid test ratio, operating expanse ratio, retention ratio, etc.

Final Thoughts:

It is another good online solvency ratio calculator website that also explains the calculation process.

| Pros | Cons |

|---|---|

| Explains calculation process | |

| Shows calculation formula |

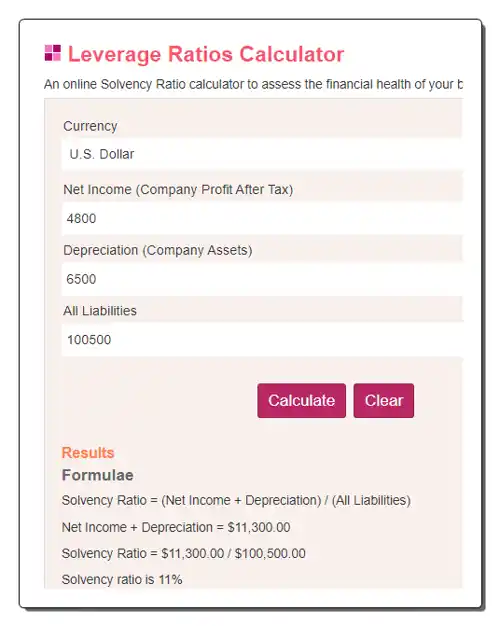

mymathtables.com

mymathtables.com is another free online solvency ratio calculator website. This website can calculate the solvency ratio for both US Dollars and Indian Rupees. To calculate the solvency ratio, it needs three primary parameters namely Net Income, Depreciation, and All Liabilities. It also shows the solvency calculation formula along with basic calculation steps. Now, follow the below steps.

How to calculate solvency ratio online using mymathtables.com:

- Go to this website and access the Leverage Ratios Calculator.

- After that, choose a currency.

- Now, enter Net Income, Depreciation, and All Liabilities values.

- Finally, tap on the Calculate button to start the calculation.

Additional Features:

- This website offers some related calculators like Free Cash Flow, Operating Cash Flow, Equity Ratio, Trading Profit Percentage, Total Inventory Cost, and more.

Final Thoughts:

It is another capable online solvency ratio calculator website that shows steps to calculate the solvency ratio.

| Pros | Cons |

|---|---|

| Explains calculation steps | |

| Shows calculation formula |

Frequently Asked Questions

Here are 4 widely used and crucial solvency ratios that offer valuable insights into a company's ability to meet its long-term obligations namely Debt-to-Equity Ratio (D/E), Debt-to-Assets Ratio, Interest Coverage Ratio, and Fixed Charge Coverage Ratio.

A solvency ratio above 1 indicates that the company's net income is sufficient to cover its total liabilities. In the case of a solvency ratio of 1.5, it suggests that the company has 1.5 times more net income than total liabilities, which is generally considered a positive sign. A higher solvency ratio is often interpreted as a better indication of a company's long-term financial stability and ability to meet its debt obligations.

There isn't a single "standard" solvency ratio that applies universally to all companies, as the appropriate level of solvency can vary across industries and depend on specific circumstances. The solvency ratio is a relative measure, and what may be considered healthy for one industry might not be suitable for another. Generally, a solvency ratio greater than 20-25% is often seen as a sign of financial stability. This means that the company's net income is at least 20-25% of its total liabilities. However, the ideal solvency ratio can depend on factors such as the nature of the business, the industry it operates in, and the overall economic conditions.

Boosting profitability through increased sales, cost control, and operational efficiency can contribute to higher net income. Pay down existing debt to reduce total liabilities. This might involve making additional debt payments or refinancing existing debt at more favorable terms. Reducing debt can improve the solvency ratio by decreasing the denominator in the solvency ratio formula.

Naveen Kushwaha

Passionate about tech and science, always look for new tech solutions that can help me and others.

About Us

We are the team behind some of the most popular tech blogs, like: I LoveFree Software and Windows 8 Freeware.

More About UsArchives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014