8 Best Free Online Home Loan Affordability Calculator Websites

Here is a list of best free online home loan affordability calculator websites. Home loan affordability refers to the home loan amount that home buyers can easily pay back in a certain tenure. While looking for a new home, homebuyers need to estimate their loan affordability amount as it prevents them from excessive financial burdens due to home loan payments that they cannot sustain. If you also want to calculate home loan affordability, check out these online home loan affordability calculator websites.

Using these websites, users can estimate the right home loan amount that they can repay without straining their current and future financials. To do this calculation, these calculators consider multiple financial parameters like Annual Household Income, Monthly Debt, Taxes, Loan Tenure, Down Payment, Debt to Income Ratio, etc. After the calculation, users can view the affordable home loan amount in US dollars. Users also get a monthly EMI payment amount that they can sustain. However, users can also adjust the EMI repayment amount by affecting the original home loan affordability amount. Some calculators break down financials into percentages and show them in the form of one or more Pie charts. To help novice users, I have included the necessary calculation steps in the description of each website.

These websites carry some related tools like Mortgage Calculators, Home Value Estimators, FD Calculators, Amortization Calculators, and more. Go through the list to learn more about these websites.

My Favorite Online Home Loan Affordability Calculator Website:

zillow.com is my favorite website as it considers all essential financial parameters to accurately estimate an optimum affordable home loan amount.

You can also check out lists of best free Online Piggyback Loan Calculator, Online Student Loan Repayment Calculator, and Online Reducing Interest Rate Calculator websites.

Comparison Table:

| Features/Website Names | Suggests monthly EMI amount | Considers all essential financial parameters for home loan affordability | Breakdown home loan affordability parameters |

|---|---|---|---|

| zillow.com | ✓ | ✓ | ✓ |

| toolbox.coderstea.in | ✓ | ✓ | ✓ |

| usbank.com | ✓ | x | x |

| calculator.net | ✓ | ✓ | ✓ |

| nerdwallet.com | ✓ | x | x |

| wellsfargo.com | ✓ | x | x |

| bankofamerica.com | ✓ | x | x |

| chase.com | ✓ | ✓ | x |

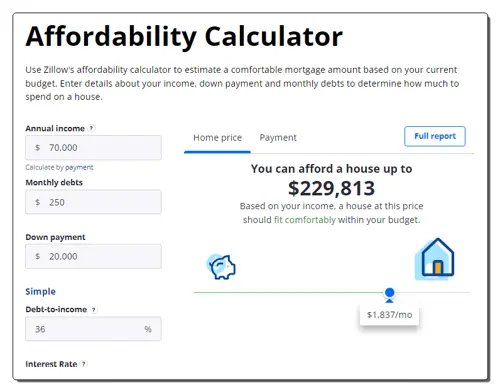

zillow.com

zillow.com is a free online home loan affordability calculator. This website helps users estimate the cost of the home that they can afford based on their annual income, monthly debts, down payments, debt-to-income percentage, home loan interest rate, and loan term in months. The advanced options of this website can also include some advanced parameters (primary mortgage insurance, property tax, home insurance, HOA dues, etc.) in the home loan affordability calculation.

After the calculation, it shows the price of the home that you can afford in US dollars. It also generates pie charts highlighting monthly budget and payment breakdowns. It even generates a table highlighting the monthly interest amount, principal amount, and principal remaining amount. Now, follow the below steps.

How to perform home loan affordability calculations online using zillow.com:

- Go to this website and access the Affordability Calculator.

- Now, enter annual income, monthly debts, down payment, debt to income, interest rate, taxes, etc.

- Next, view the amount of a house that you can afford.

- Finally, click on the Full Report button to view detailed affordability parameters along with multiple charts and graphs.

Additional Features:

- This website has multiple online tools such as Amortization Calculator, Debt-to-income Calculator, Mortgage Calculator, Refinance Calculator, and more.

Final Thoughts:

It is one of the best free online home loan affordability calculator websites that helps users estimate the amount of home loan they can afford based on their finances, taxes, and debts.

| Pros | Cons |

|---|---|

| Shows monthly budget and payment breakdown pie charts | |

| Generates Amortization schedule breakdown table |

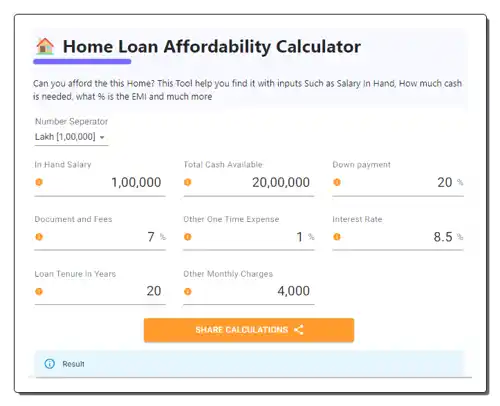

toolbox.coderstea.in

toolbox.coderstea.in is a free online home loan affordability calculator website. It helps users gather important financial insights needed to make the right home-buying decisions. To calculate home loan affordability, it considers multiple inputs like monthly salary, home price, available cash, government fees, one-time charges, home loan interest rate, loan tenure, and monthly home-related expenses. After performing the calculation, it shows the down payment amount, final home price, loan disbursed by the bank, total cash needed, remaining cash at hand, EMI amount, EMI % of salary, remaining monthly salary after EMI, etc. Based on the obtained values, users can make the right home purchasing decisions. Now, follow the below steps.

How to calculate home loan affordability online using toolbox.coderstea.in:

- Visit this website and access the home loan affordability calculator.

- After that, choose Lakh or Thousand as the number separator.

- Now, enter in hand salary, total cash available, down payment percentage, document and fees, interest rate, etc., parameters.

- Next, view the calculated home loan affordability parameters like home price, final home price, loan disbursed by bank, total cash needed, EMI, remaining monthly salary after EMI, etc.

Additional Features:

- This website has some handy tools like FD Calculator, Base 64 Encoder and Decoder, URL Encoder, URL Decoder, etc.

Final Thoughts:

It is a good online home loan affordability calculator that calculates all the important parameters needed to assess home loan affordability.

| Pros | Cons |

|---|---|

| Explain home loan affordability | |

| Calculates all essential home loan affordability parameters |

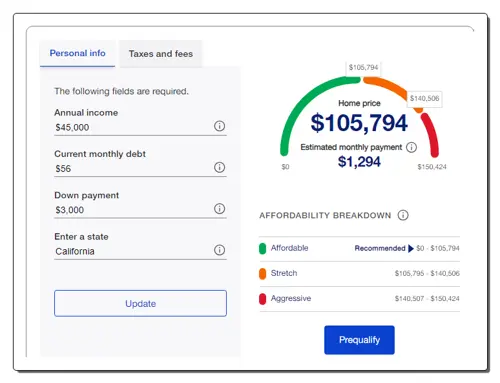

usbank.com

usbank.com is another free online home loan affordability calculator website. This website offers a simple home loan affordability calculator that uses annual income, current monthly debt, down payment, state name, property tax, insurance, loan term, and interest value parameters to suggest the right home loan amount that you can afford. It also suggests stretched and aggressive home prices that users can consider. Now, follow the below steps.

How to perform home loan affordability calculation online using usbank.com:

- Visit this website using the given link.

- After that, enter all personal info, taxes, and fees data.

- Next, click on the Update button to view the affordable home loan price along with the stretched and aggressive home loan prices.

Additional Features:

- This website offers multiple related tools like today’s mortgage rates, monthly payment calculator, wealth planning tools, insurance tools, and more.

Final Thoughts:

It is another good online home loan affordability calculator that helps users quickly estimate the right home loan amount based on their finances.

| Pros | Cons |

|---|---|

| Estimates affordable, stretched, and aggressive home loan prices |

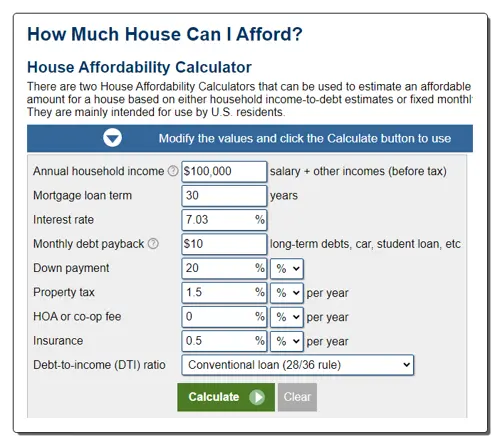

calculator.net

calculator.net is a free online home loan affordability calculator website. This website offers two different types of house affordability calculators. The first calculator uses household income and debt values like annual income, mortgage loan term, interest rate, down payment, property tax, etc., to estimate home loan affordability. On the other hand, the second calculator uses fixed and monthly budget parameters (monthly budget for house, mortgage loan term, interest rate, down payment, and taxes) to calculate home loan affordability. After the calculation, it shows a home loan amount that you can afford. A breakdown of all the important home loan parameters is also provided. Now, follow the below steps.

How to perform home loan affordability calculator online using calculator.net:

- Go to this website and access the house affordability section.

- After that, select one of the two available calculators.

- Next, enter all the financial and debt values it requires.

- Finally, click on the Calculate button to start the calculation process.

Additional Features:

- This website has multiple financial calculators such as Amortization, Rent, Refinance, APR, FHA Loan, VA Mortgage, etc.

Final Thoughts:

It is another good online home loan affordability calculator website that offers two separate calculators to calculate home loan affordability.

| Pros | Cons |

|---|---|

| Offers two separate calculators to calculate home loan affordability | |

| Describes the parameters involved in the calculation |

nerdwallet.com

nerdwallet.com is another free online home loan affordability calculator website. It helps users estimate the home loan amount that they can take based on their finances. This calculator also considers the state in which you live in the U.S. To perform the calculation, it needs five main parameters namely Annual Income, Minimum monthly Debt, Loan Down Payment Amount, Loan Term, and Status (whether you are a veteran or not). After the calculation, it shows the affordable monthly payment in US dollars. Besides this, it also highlights debt to income ratio of various elements like housing rent, debts, savings, etc. It also divides monthly house payments into mortgage payment, property tax, insurance, and HOA fees amount. Now, follow the below steps.

How to perform home loan affordability calculation online using nerdwallet.com:

- Go to this website using the given link.

- After that, enter annual income, minimum monthly debt, loan term, and downpayment amount values.

- Next, view the affordable monthly home loan payment you can afford.

Additional Features:

- This website answers common queries related to home loan affordability calculation.

- A good set of financial services are offered by this website like Credit Score Check, Financial Planning, Insurance Services, Retirement Planning, etc.

Final Thoughts:

It is another capable online home loan affordability calculator website that helps users calculate the affordable monthly home loan payment amount.

| Pros | Cons |

|---|---|

| Helps users estimate the affordable monthly home loan payment amount | |

| Shows debt to-income ratio |

wellsfargo.com

wellsfargo.com is another free online home loan affordability calculator website. This website offers a simple home loan affordability calculator that helps users estimate the amount of home loan they can take without ruining their finances. To perform this calculation, it uses seven main parameters such as Annual Income, Monthly Debt, Down Payment amount, City, State, Loan Term, and Interest Rate.

After the calculation, it shows the home price that you can afford along with the debt-to-income ratio. Users can also specify the monthly home loan payment that they can comfortably sustain to view the adjusted home loan price. It also generates a monthly payment breakdown pie chart highlighting the percentage of principal & interest, estimated taxes, mortgage insurance, and homeowner insurance. Now, follow the below steps.

How to perform home loan affordability calculation online using wellsfargo.com:

- Visit this website and go to home loan affordability calculator.

- After that, enter all financial data like annual income, monthly debt, home downpayment amount, interest rate, loan term, etc.

- Now, specify the City and State of the United States.

- Finally, view the calculated affordable home loan amount.

Additional Features:

- This website offers financial services like loans for small businesses, commercial banking services, investing & wealth management services, etc.

Final Thoughts:

It is another good online home loan affordability calculator website that helps users estimate the right home loan amount.

| Pros | Cons |

|---|---|

| Uses basic financial parameters to estimate affordable home loan amount |

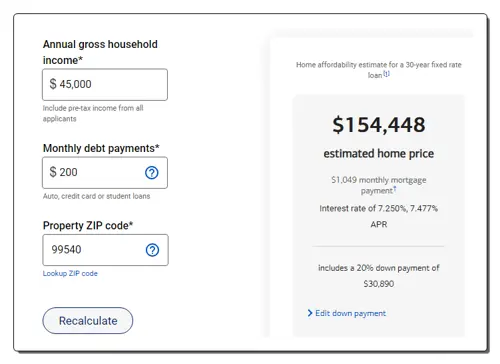

bankofamerica.com

bankofamerica.com is another free online home loan affordability calculator website. This website offers one of the simplest online loan affordability calculators that only uses annual gross household income, monthly debt payments, and property Zip code to estimate the home loan price in US dollars. It also shows an affordable monthly mortgage payment amount. Users can add a downpayment amount to get the new affordable home loan value. Now, check out the below steps.

How to calculate home loan affordability online using bankofamerical.com:

- Open the interface of this website and go to the home affordability calculator.

- Enter annual gross household income, monthly debt payments, and property ZIP code.

- Next, specify the down payment.

- Finally, view the calculated home loan price.

Additional Features:

- This website offers some related tools like estimating home value, closing costs calculator, today’s mortgage rates, etc.

Final Thoughts:

It is another good online home loan affordability calculator that anyone can use to find the best home loan price based on their finances.

| Pros | Cons |

|---|---|

| Only requires three parameters to perform the calculation | Doesn’t consider important financial parameters in the calculation |

| Easy to use |

chase.com

chase.com is the last free online home loan affordability calculator website. This website considers multiple Loan & Borrower, and Taxes & Insurance parameters to calculate home loan affordability. It also generates the pie chart highlighting the percentage of principal & interest, homeowner insurance, private mortgage insurance, property taxes, and HOA in all expanses. Now, follow the below steps.

How to calculate home loan affordability online using chase.com:

- Visit this website using the given link.

- After that, enter all loan & borrower and taxes & insurance values.

- Next, view the calculated affordable home loan price in dollars.

Additional Features:

- This website has additional calculators such as FHA Calculator, Mortgage Calculator, Home Value Estimator, and more.

Final Thoughts:

It is another good online home loan affordability calculator website that anyone can use with ease.

| Pros | Cons |

|---|---|

| Considers all essential parameters to calculate home loan affordability |

Frequently Asked Questions

There isn't a one-size-fits-all rule for home loan affordability, as it depends on various factors including individual financial situations, goals, and the lending institution's criteria. However, there are some general guidelines and rules of thumb that people often use to estimate how much home they can afford. One widely used rule is the 28/36 rule: Front-End Ratio (28%), Back-End Ratio (36%), A larger down payment can reduce the loan amount and, consequently, the monthly mortgage payment. Higher Credit Score, and Maintain an emergency fund.

Calculating loan affordability involves considering various financial factors to determine how much you can comfortably borrow and repay. The first step is the determine your gross monthly income. Next, calculate the front-end ratio, calculate the back-end ratio, estimate monthly mortgage payment, consider down payment, check credit score, assess personal comfort level, and consult with a mortgage professional.

The 80/20 rule, in the context of home loans, typically refers to a specific type of financing arrangement known as an "80/20 mortgage" or "piggyback loan." This structure involves taking out two loans to purchase a home, with the first mortgage covering 80% of the home's purchase price and the second mortgage covering the remaining 20%. This method is also known as a combination or piggyback loan.

The 30/30/3 rule suggests that you should allocate 30% of your gross monthly income to your mortgage payment: 30% of your gross monthly income to other essential expenses: and remaining 40% of your gross monthly income for everything else.

Affordability criteria refers to a set of standards used to determine whether something, like housing, healthcare, or a particular good or service, is within the financial reach of a specific group or individual. It's often used in the context of ensuring people can access necessities without undue hardship.

Naveen Kushwaha

Passionate about tech and science, always look for new tech solutions that can help me and others.

About Us

We are the team behind some of the most popular tech blogs, like: I LoveFree Software and Windows 8 Freeware.

More About UsArchives

- May 2024

- April 2024

- March 2024

- February 2024

- January 2024

- December 2023

- November 2023

- October 2023

- September 2023

- August 2023

- July 2023

- June 2023

- May 2023

- April 2023

- March 2023

- February 2023

- January 2023

- December 2022

- November 2022

- October 2022

- September 2022

- August 2022

- July 2022

- June 2022

- May 2022

- April 2022

- March 2022

- February 2022

- January 2022

- December 2021

- November 2021

- October 2021

- September 2021

- August 2021

- July 2021

- June 2021

- May 2021

- April 2021

- March 2021

- February 2021

- January 2021

- December 2020

- November 2020

- October 2020

- September 2020

- August 2020

- July 2020

- June 2020

- May 2020

- April 2020

- March 2020

- February 2020

- January 2020

- December 2019

- November 2019

- October 2019

- September 2019

- August 2019

- July 2019

- June 2019

- May 2019

- April 2019

- March 2019

- February 2019

- January 2019

- December 2018

- November 2018

- October 2018

- September 2018

- August 2018

- July 2018

- June 2018

- May 2018

- April 2018

- March 2018

- February 2018

- January 2018

- December 2017

- November 2017

- October 2017

- September 2017

- August 2017

- July 2017

- June 2017

- May 2017

- April 2017

- March 2017

- February 2017

- January 2017

- December 2016

- November 2016

- October 2016

- September 2016

- August 2016

- July 2016

- June 2016

- May 2016

- April 2016

- March 2016

- February 2016

- January 2016

- December 2015

- November 2015

- October 2015

- September 2015

- August 2015

- July 2015

- June 2015

- May 2015

- April 2015

- March 2015

- February 2015

- January 2015

- December 2014

- November 2014

- October 2014

- September 2014

- August 2014

- July 2014

- June 2014

- May 2014

- April 2014

- March 2014